Questioning if Boldin is the proper instrument that will help you plan for retirement? This Boldin Evaluate will break down all the things it’s essential to know. Monetary planning can really feel complicated and even scary. That’s why I used to be excited to check out Boldin (previously often known as NewRetirement). If you happen to’re somebody who needs to know in case you’re on…

Questioning if Boldin is the proper instrument that will help you plan for retirement? This Boldin Evaluate will break down all the things it’s essential to know.

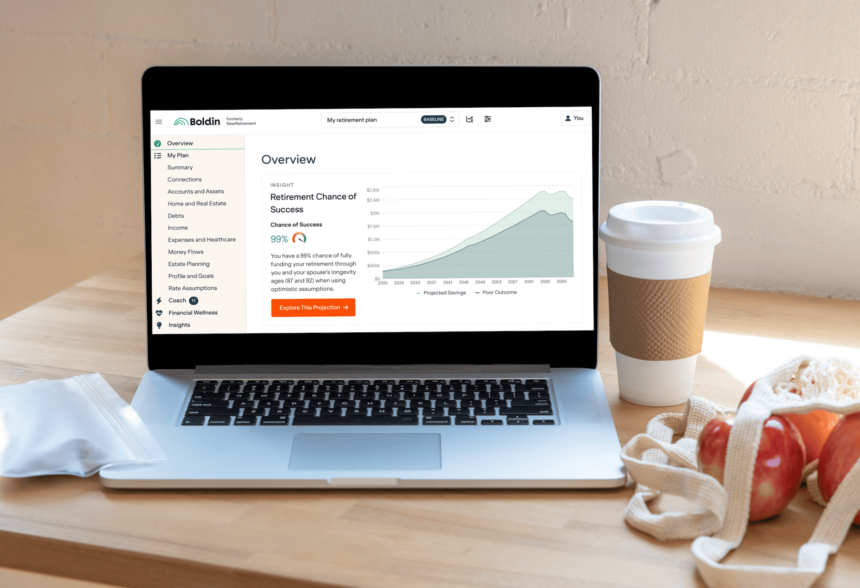

Monetary planning can really feel complicated and even scary. That’s why I used to be excited to check out Boldin (previously often known as NewRetirement). If you happen to’re somebody who needs to know in case you’re heading in the right direction, when you possibly can retire, or easy methods to make your cash final so long as attainable, this instrument might help.

Boldin is totally different from different monetary instruments as a result of it goes deep into your retirement plan. It doesn’t simply present your internet price or your spending. It helps you make good, long-term choices round social safety, taxes, healthcare, property planning, and extra.

If you wish to take monetary planning into your personal palms, I believe Boldin is a superb monetary instrument to make use of. You may run situations to make higher choices and have extra management over your cash. You may get a full evaluation of your funds, resembling your financial savings price, investments, and extra, and create a monetary plan that works for you.

Personally, I ended up spending a couple of hours on the platform simply testing totally different situations, tweaking data I entered, and actually digging into the main points. It was enjoyable to see how small modifications may make an enormous distinction in my retirement plan, and I discovered it tremendous useful to visualise all the things so clearly.

Please click on right here to check out Boldin without spending a dime.

Boldin Evaluate

On this Boldin evaluation, I’m going to stroll you thru what it’s, the way it works, who it’s for, and whether or not or not it’s price the fee.

What’s Boldin?

Boldin is a retirement planning software program that helps you create an in depth monetary plan. It was initially launched as NewRetirement, and in 2024, it modified its title to Boldin.

With Boldin, you possibly can mannequin your whole monetary journey. That features your financial savings, bills, investments, taxes, Social Safety, housing choices, retirement, and extra.

It helps you reply questions like:

- Am I saving sufficient?

- Ought to I save or repay debt?

- How a lot home can I afford?

- When can I retire?

- Can I retire early?

- Will I run out of cash?

- Ought to I convert to a Roth?

- Can I afford to assist my youngsters or give to charity?

It’s constructed for on a regular basis individuals who need to perceive their cash higher and make good decisions – with or and not using a monetary advisor.

I made a decision to check Boldin as a result of I need to discover issues which can be straightforward to make use of, useful, and reasonably priced for my readers. Once I heard that Boldin helps you to construct your personal monetary plan with out hiring an advisor, I knew I needed to give it a strive.

What stood out to me is how in-depth Boldin is. You’re not simply getting into a couple of numbers. You may truly construct a full monetary roadmap and check out totally different life choices to see how they have an effect on your future.

It’s like having a robust retirement calculator, monetary coach, and tax planner multi functional.

Able to see what your retirement plan seems like? Click on right here to create your free Boldin account. It takes just some minutes to get began.

What does Boldin allow you to do?

Boldin is all about retirement planning, and it goes approach past simply monitoring your investments.

Listed here are among the issues you are able to do with Boldin:

- Get a transparent image of your internet price

- Estimate your retirement revenue and bills

- Optimize one of the best age to assert Social Safety

- Study Roth conversions and tax planning

- Mannequin totally different housing choices, like downsizing or shifting someplace totally different

- See how totally different funding returns have an effect on your plan

- Plan for healthcare and long-term care prices

- Forecast property worth and legacy targets (how a lot cash do you need to depart your youngsters?)

- Run detailed “what-if” situations

Whether or not you’re questioning when to retire, in case you can journey extra, or if it’s protected to spend a bit of further, Boldin might help you discover the reply.

What I like about Boldin is that it’s very straightforward to make use of. You may spend 10 minutes inputting your data into the platform and calculator, or you possibly can spend hours and run tons of various situations.

Who’s Boldin for?

Boldin is a superb match for:

- People who find themselves planning for retirement

- Anybody interested in optimizing taxes, Social Safety, or healthcare

- Early retirees and FIRE motion followers

- DIY cash managers who need to keep away from excessive advisory charges

Actual individuals use the platform to:

- Determine whether or not to retire now or later

- Mannequin the impression of shopping for a second residence

- Determine one of the best time to assert Social Safety

- Plan for healthcare prices throughout early retirement

Individuals say that Boldin offers them peace of thoughts, extra confidence, and helps them keep away from pricey errors.

How does Boldin work?

Boldin is a instrument that helps you construct your personal personalised retirement plan. You may create a free account in just some minutes and instantly begin including in your data.

To get began with Boldin, right here’s what it’s a must to do:

- Join a free account on the Boldin web site.

- Enter your private monetary data, resembling revenue, belongings, financial savings, retirement targets, and bills. You may enter as a lot or as little as you need to enter (there are over 100 knowledge factors you possibly can enter, if you wish to).

- Use the planning instruments to construct and customise your retirement plan. This consists of including life occasions like downsizing your house, retiring early, or doing a Roth conversion.

- Discover your dashboard to view projections, evaluate what-if situations, and get readability on whether or not your plan is on observe.

One in all my favourite issues about Boldin is how detailed and versatile it’s.

You may go as deep as you need, and also you don’t even must hyperlink your accounts in case you want getting into issues manually. It’s good for anybody who needs to plan their very own retirement and really feel assured about their future.

Boldin’s Greatest Instruments

After utilizing the instrument myself, listed here are the options that I believe are price it:

1. What-if state of affairs comparisons

Wish to know what would occur in case you retired at 40 as a substitute of 65? If you happen to took social safety a pair years early? Or moved to a special state?

You may create and evaluate totally different variations of your plan. Plus, each time you run a state of affairs or make a change to your plan, you’re going to get instantaneous suggestions from Boldin.

I believe that is so useful for decision-making and understanding your choices.

2. Roth Conversion Explorer

This function helps you discover when and the way a lot to transform from a tax-deferred account to a Roth IRA. It seems at your tax bracket and revenue projections.

You may check out totally different begin/cease years, quantities, and see the impression over time. It’s one of the vital superior Roth conversion instruments I’ve seen.

3. Suggestions on easy methods to enhance

Boldin sends you alerts that may allow you to retire sooner and handle your cash higher.

For instance, you might get an alert that claims, “Primarily based in your knowledge, in case you paid an extra $250 every month, your mortgage might be paid off earlier than you retire.”

These little actionable ideas are very useful!

4. Lessons and dwell occasions

Boldin PlannerPlus customers can be part of dwell classes to ask questions and be taught straight from Boldin specialists. It’s an effective way to get help and see how others are utilizing the instrument.

For instance, among the courses and occasions I see proper now embody (there are a number of dwell occasions every week, plus courses you possibly can entry at any time):

- Elevating Financially Savvy Kids

- Discussing Funds with Your Accomplice

- Purchase or Lease a House

- 15 or 30 12 months Mortgage

- HSA Account Fundamentals

- Tax Planning

- Retirement Revenue Planning

- Property Planning

5. Actual-time monitoring of your private monetary state of affairs

With Boldin, you will get a fast snapshot of the place you stand and what it’s essential to do.

Sure, you possibly can see your internet price, and you may also create a “watchlist” – which I actually, actually love. That is most likely considered one of my most favourite options on Boldin.

For instance, you possibly can watch your:

- financial savings price

- retirement financial savings projection

- money circulate

- earliest attainable retirement date

- retirement countdown

- complete debt ratio

And extra. There are round 25 totally different metrics you possibly can watch.

Questioning what your likelihood of economic success is? With Boldin, you possibly can construct your personal monetary plan and be taught methods to do higher.

How A lot Does Boldin Value?

Boldin has each a free plan and a paid plan referred to as PlannerPlus.

- Free plan – You get entry to the fundamental dashboard, some calculators, and easy projections. This plan is nice in case you’re simply beginning out and need a fast overview of your retirement image. You may get conversant in the platform and discover your funds with out spending any cash.

- PlannerPlus – This plan prices $10 a month or $120 per yr and comes with a 14-day free trial. With PlannerPlus, you get all the things within the free plan, plus you get to make use of the entire premium instruments, resembling Roth conversion instruments, tax methods, detailed budgeting and revenue planning, dwell courses, Monte Carlo evaluation (to check your plan in opposition to threat), real-time internet price evaluation, a full library of courses and weekly dwell occasions, the choice to hyperlink your accounts for real-time updates, and extra. PlannerPlus is finest for individuals who prefer to run totally different situations, optimize tax technique, or plan for healthcare and long-term care prices. The improve is certainly price it.

Which plan do you want?

- Keep on with the free plan if you would like a primary overview of the place you stand.

- Go along with PlannerPlus if you would like detailed insights, highly effective instruments, and ongoing help as you put together for (or dwell in) retirement.

Personally, I believe you get plenty of nice options with both plan. I examined out each the free plan and the PlannerPlus plan (I personally have the PlannerPlus proper now), and I believe the knowledge you get in every is nice.

Execs and Cons of Boldin

Right here’s what I believe are the professionals and cons of Boldin:

Execs:

- Simple-to-use monetary planning instruments

- Useful visible charts and graphs

- Reasonably priced pricing and even a free plan

- Doesn’t require linking your accounts

- Tremendous personalised and goal-based

Cons:

- Could really feel overwhelming at first if you wish to add your entire data. I’ll say, although, that it’s pretty straightforward so as to add all the things!

- No cell app. For me, I don’t care about this, however if you wish to apply it to your cellphone, you’ll simply should log in by means of an web browser as a substitute.

Steadily Requested Questions

Beneath are solutions to widespread questions on Boldin.

Is Boldin Planner Plus price it?

Sure, I imagine Boldin’s PlannerPlus is price it in case you’re severe about planning your retirement. The free model is a superb place to begin, however PlannerPlus offers you entry to the extra highly effective options that basically make a distinction – like tax technique modeling, Roth conversion instruments, actual property planning, and detailed what-if situations.

For instance, you possibly can mannequin situations like totally different budgets (resembling pre-retirement, early retirement, and late retirement), mannequin Roth conversions to see the impression in your taxes, mannequin relocating your major residence (you possibly can see how downsizing or relocating to a different state can impression your retirement), mannequin withdrawal methods for taxes, and extra.

You additionally get entry to dwell courses the place you possibly can ask questions and get assist. For $10 a month or $120 a yr, it’s an reasonably priced option to get extra management over your future and make smarter choices. If you happen to’re excited about retirement or already retired, PlannerPlus might help you’re feeling extra assured and ready.

Do I must hyperlink my accounts?

No, you do not want to hyperlink your accounts to Boldin in case you don’t need to. You may enter all the things manually in case you want.

Does Boldin work for {couples}?

Sure! You may mannequin plans for one or two individuals, and it’s nice for joint planning.

Is Boldin higher than Empower?

Boldin and Empower are totally different they usually serve totally different functions, so it actually will depend on what you want. Empower (previously Private Capital) is nice for monitoring your internet price and viewing your investments. It’s a superb dashboard in case you’re targeted on funding administration and need to see your internet price.

Boldin, alternatively, is targeted on planning. It helps you suppose by means of retirement timing, tax methods, spending in retirement, healthcare prices, and extra. If you wish to perceive your future monetary image and actively plan for it, Boldin is an efficient selection.

In actual fact, many individuals use each instruments collectively – Empower for funding monitoring and Boldin for retirement planning. That approach, you get one of the best of each worlds.

Can I take advantage of Boldin with a monetary advisor?

Sure, many Boldin customers share their plans with advisors or use it to information monetary planning conferences.

Is Boldin straightforward to make use of?

I discovered Boldin very straightforward to make use of. You may set all the things up in just some minutes, or you possibly can spend hours and actually dive into the entire totally different options. It actually simply will depend on what you might be on the lookout for.

Is Boldin protected to make use of?

Sure, Boldin is protected to make use of. Boldin makes use of bank-level encryption and follows strict knowledge privateness requirements. And, you should use the platform with out linking your precise financial institution or funding accounts. Which means you retain management and may enter all the things manually in case you’d like.

Why did New Retirement change to Boldin?

The corporate modified its title from NewRetirement to Boldin in 2024 to higher replicate its mission. The brand new title, Boldin, comes from the thought of serving to individuals be daring in retirement – to trust of their monetary plan. Whereas the title modified, the instrument is identical.

Boldin Evaluate – Abstract

I hope you loved my Boldin Evaluate.

So, is Boldin price it?

Sure, I believe in case you’re getting ready for retirement or already there, Boldin is without doubt one of the finest instruments on the market. It helps you reply the large questions and offers you actual peace of thoughts.

I believe it’s nice for planners like me who’re at all times operating situations of their heads or in spreadsheets. It’s good to have all the things specified by an easy-to-use platform that robotically generates graphs and actionable ideas for you.

I personally plan on retaining my subscription that I began and referring to it repeatedly.

Boldin lets you:

- Be extra organized

- Set monetary targets

- See what actions you possibly can take to handle your cash higher or retire earlier

- Make knowledgeable choices

And extra.

If you happen to’re able to take management of your future, I extremely suggest checking it out.

Please click on right here to check out Boldin without spending a dime.

Have you ever used Boldin? Do you like constructing your retirement plan with a instrument like this, or do you keep on with spreadsheets or a monetary advisor?

Be aware: To guard my privateness, the photographs on this Boldin Evaluate will not be of my private funds – they have been both supplied by Boldin or have been made with a separate check account that I made.

Advisable studying: