Picture supply: Getty Pictures

Searching for methods to generate an enormous second earnings over time? Listed below are three high tricks to take into account for the New 12 months.

1. Use an ISA and/or a SIPP

The very first thing to consider is opening an Particular person Financial savings Account (ISA). Each the Shares a Shares ISA and Lifetime ISA permit buyers to purchase shares, funds, and trusts.

Buyers also needs to take into consideration opening a Self-Invested Private Pension (SIPP), a product that enables entry to those asset courses as effectively.

These three merchandise have totally different guidelines regarding withdrawals and annual allowances. However every is value critical consideration on condition that customers don’t pay a penny in capital positive aspects tax or dividend tax. Over time, this could add as much as critical cash.

What’s extra, with Lifetime ISAs and SIPPs, the federal government successfully offers savers and buyers cash by means of tax aid. This supplies savers and buyers with further sources for compounding wealth in the long term.

2. Select correctly

There are actually tens of hundreds of belongings buyers can select from right this moment. Whereas overwhelming, such a broad choice provides a wealth of alternative.

Every considered one of us has totally different monetary targets, investing kinds, and tolerance of threat. So there’s no blueprint as to what the right portfolio will likely be.

One good thought is to look at what different profitable buyers have been shopping for and promoting. I’m a eager watcher of what ‘Sage of Omaha’ Warren Buffett‘s been buying and selling together with his Berkshire Hathaway funding agency. Given his $100bn+ fortune, his buying and selling exercise’s all the time value being attentive to.

However no matter what others are doing, what inventory ideas chances are you’ll learn, or what market traits look white sizzling, it’s important that you just do your individual analysis earlier than shopping for and promoting any asset. Even the likes of Buffett get it mistaken. So pore over buying and selling statements, steadiness sheets, trade reviews, and different materials your self.

3. Construct a diversified portfolio

Whereas the precise belongings we purchase can differ markedly, constructing a diversified portfolio is a important technique each investor ought to take into account.

Doing this can assist cut back threat and supply a secure return throughout the financial cycle. It additionally means buyers get publicity to a myriad of alternatives that may supercharge their portfolios.

This yr I’ve purchased an big range of progress, dividend, and worth shares like baker Greggs, insurer Aviva, drinks bottler Coca-Cola CCH, and constructing supplies provider CRH. I’ve additionally bought exchange-traded funds (ETFs) just like the Xtrackers MSCI World Momentum ETF (LSE:XDEM).

As its title implies, this fund invests in a variety of world equities, 350 in complete, with money unfold throughout large- and mid-cap corporations. Massive holdings right here embrace tech shares Apple and Nvidia, though different sectors like industrials, financials, and telecoms are effectively represented, offering respectable diversification.

Its concentrate on momentum shares is usually a threat, as a result of these shares are sometimes priced based mostly on latest sturdy efficiency, which might not be sustainable. However its assortment of established heavyweight names helps soothe any fears I’ve.

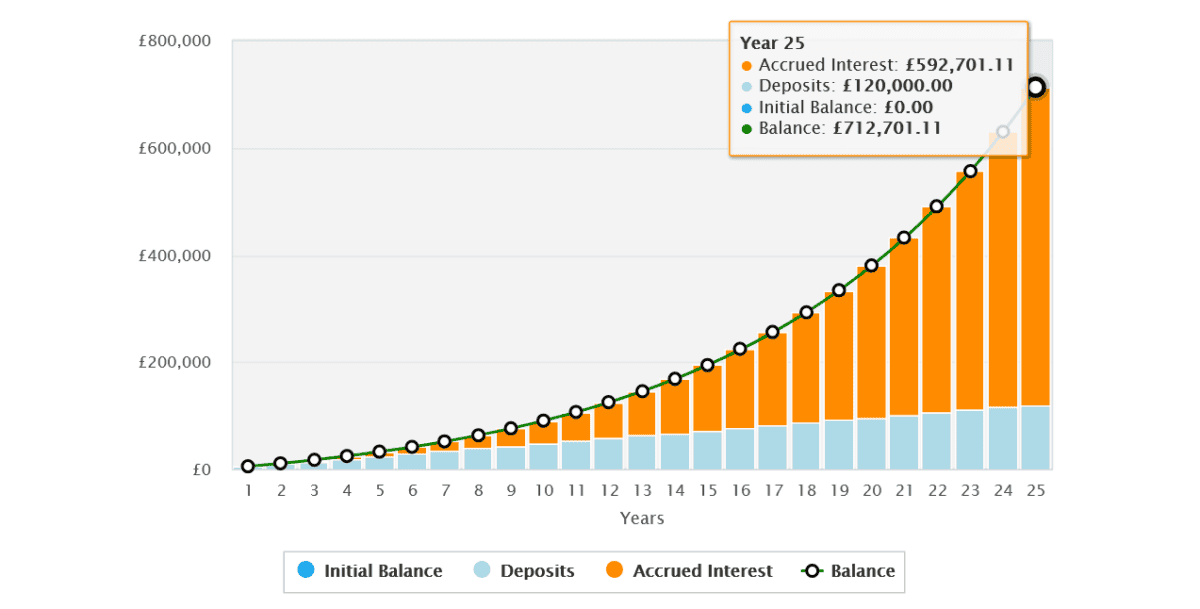

So does the fund’s strong returns, which since 2014 have averaged 11.7%. Based mostly on this efficiency, a £400 month-to-month funding right here might generate £712,701 after 25 years. This might then create an annual passive earnings of £28,508 based mostly on a 4% drawdown charge.