Key takeaways

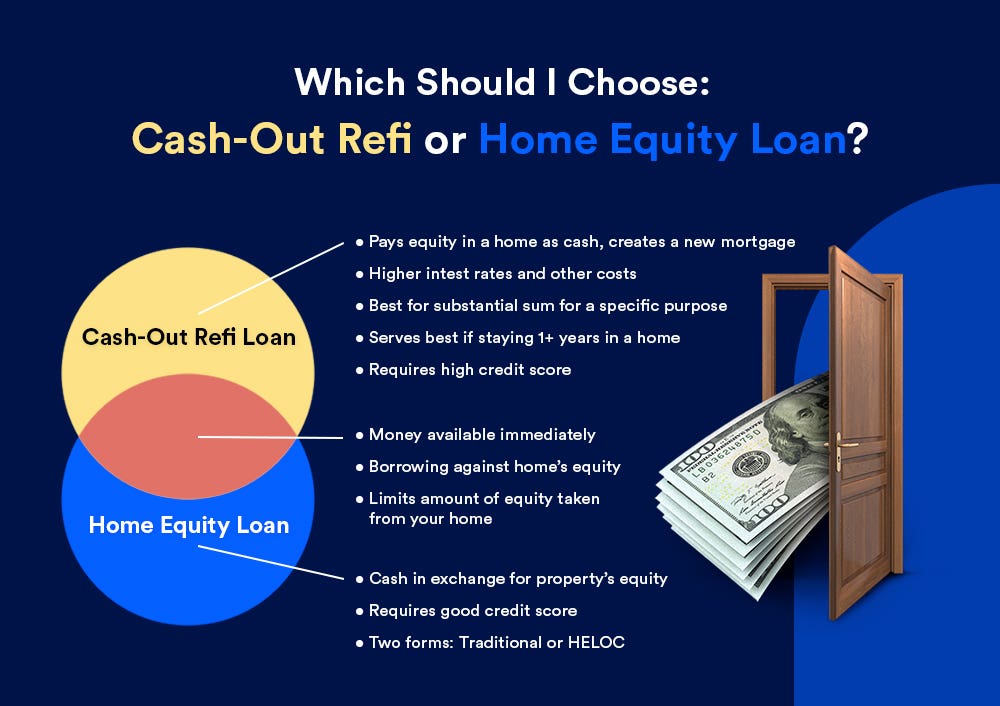

- A cash-out refinance and residential fairness mortgage are each strategic methods to entry the possession stake you have constructed in your house.

- A cash-out refinance is the method of changing your current mortgage with a brand new one, whereas a house fairness mortgage is a second mortgage you’re taking out on high of your main one.

- A house fairness mortgage works properly you probably have a giant possession stake and wish a big, mounted lump sum.

- A cash-out refinance will be the smarter choice if you would like a decrease rate of interest and to cope with only one large debt.

For those who want cash and have a large quantity of house fairness constructed up, you might wish to faucet into that fairness for the funds. Each a cash-out refinance and a house fairness mortgage mean you can borrow towards your possession stake, utilizing your house as collateral.

A cash-out refinance is the method of changing your current mortgage with a brand new one, whereas a house fairness mortgage is a second mortgage you’re taking out on high of your main one.

For those who’re weighing a money out refinance vs. a house fairness mortgage, how do you resolve which is the higher choice? Listed here are the advantages and dangers to think about for every.

Money-out refinance vs. house fairness mortgage

Money-out refinance |

House fairness mortgage |

|---|---|

| Fastened or adjustable rate of interest | Fastened rate of interest |

| Barely increased rates of interest than conventional mortgages | Greater rates of interest, 2-3% above mortgage charges |

| Should preserve 15% – 20% house fairness | Should preserve 15% – 20% house fairness |

| Curiosity is tax-deductible on authentic mortgage principal; cashed-out portion deductible if used on the house | Tax-deductible curiosity, supplied funds are used to “purchase, construct, or considerably enhance” the house |

| Longer utility course of | Shorter utility course of |

What’s a cash-out refinance?

A cash-out refinance pays off the remaining steadiness in your first house mortgage and replaces it with a brand new mortgage. The newly refinanced mortgage quantity is for the remaining debt owed on the primary mortgage, plus the quantity you’re “cashing out” — that’s, borrowing — from the fairness. The mortgage time period is usually as much as 30 years, and the rate of interest — which could be mounted or variable — will mirror prevailing market charges. Money-out refi charges are usually a bit increased than conventional rate-and-term refinance charges.

Some lenders and federal applications could set decrease credit score rating necessities for cash-out refinancing. As a result of the refinancing lender assumes the primary mortgage throughout a cash-out refi, that lender turns into the first lien-holder within the occasion you default. With simpler entry to your house as collateral, lenders is perhaps prepared to supply decrease charges in comparison with what you’ll get with a house fairness mortgage.

Execs

Execs

- Decrease credit score necessities

- One mortgage moderately than a number of loans

- Could enhance credit score rating

- Decrease rates of interest than different kinds of debt

- Can be utilized for any goal

Cons

Cons

- Threat of foreclosures

- Lengthy utility course of

- At the very least 20% house fairness stake required

- Closing prices could be excessive

- Low debt-to-income ratio required

Potential charges related to a cash-out refinance

Closing prices for money out refis usually vary from 2 % to six % of the mortgage’s quantity. Money out refis normally price lower than main mortgages, as they don’t require sure bills, like title searches and title insurance coverage, which are frequent when shopping for a house. However you possibly can count on to see sure acquainted charges: The lender will probably cost you for an appraisal of the property, for instance.

What’s a house fairness mortgage?

A house fairness mortgage has a wide range of makes use of: a method to fund big-ticket purchases, make pricey house upgrades and consolidate high-interest debt.

It’s a second mortgage towards your house with its personal phrases and rate of interest which are separate out of your first mortgage. By refinancing utilizing a house fairness mortgage, you’re borrowing towards the house’s fairness — the distinction between the appraised worth of your house and what you owe in your mortgage. You may usually borrow as much as 85 % of your house’s fairness. Nonetheless, your mortgage dimension is dependent upon different monetary components, like your revenue and credit score historical past, and the excellent steadiness in your first mortgage.

House fairness loans usually have a reimbursement interval of as much as 30 years, similar to mortgages. House fairness mortgage charges could also be increased than these of refis. The variations, nonetheless, range considerably from lender to lender and over time.

Execs

Execs

- Fastened charges provide certainty

- Decrease charges than unsecured debt

- Lengthy reimbursement phrases/low month-to-month funds

- Curiosity could be tax-deductible

- Use the money for nearly any goal

Cons

Cons

- Foreclosures danger: house is collateral

- Greater credit score necessities

- 15%-20% house fairness required

- Have to be paid off when house is offered

- Simple to overborrow because of lump sum distribution

Potential charges related to house fairness loans

House fairness mortgage charges range a superb deal amongst lenders, highlighting the significance of evaluating presents. Whereas some lenders waive origination charges — usually a giant chunk of complete closing prices — they might implement a barely increased rate of interest as compensation. And it’s probably that, as with the refi, you’ll should pay for an appraisal and numerous administrative charges. On the whole, although, house fairness mortgage closing prices are usually decrease than these for a refi, understanding to 2 % to five % of the mortgage principal. That’s partly as a result of you might incur fewer prices, but in addition since you’re probably borrowing a smaller quantity, so percentage-based bills — like origination charges — can be much less.

When does a cash-out refinance make sense?

Money-out refis usually have decrease rates of interest and are simpler to qualify for, making them interesting for individuals who have less-than-perfect credit score scores. They provide an choice for homebuyers to borrow a lump sum for deliberate bills, with solely a single reimbursement to trace.

Nonetheless, they exchange your current mortgage with a brand new one, that means a brand new fee time period and rate of interest. You’ll should pay new closing prices, too. For those who received a terrific deal in your preliminary mortgage, you won’t wish to give it up if charges have considerably risen these days. Or, should you’ve had your mortgage a very long time, and your funds are actually primarily going in the direction of principal (not curiosity), you won’t wish to reset the amortization clock with a brand new mortgage.

A cash-out refi additionally tends to make sense should you have been pondering of swapping out your present mortgage anyway — maybe due to a giant drop in rates of interest. Additionally if you may get a greater price on a brand new mortgage than you could have in your current one or, you wish to regulate the reimbursement time period of your mortgage.

When does a house fairness mortgage make sense?

House fairness loans allow you to hold your current mortgage and add a brand new mortgage on high. That may be useful should you received a superb deal in your authentic mortgage and wish to hold it for so long as attainable. Or simply don’t wish to mess with it, generally.

A house fairness mortgage is an choice for individuals who’ve paid down a superb chunk of their mortgage and constructed up a variety of fairness of their houses, and who’ve a robust credit score historical past and rating. The general strategy of taking out a house fairness mortgage could be easier and faster than a cash-out refinance, too.

In case your financials make sure you’ll get a superb price on the mortgage — one which’s aggressive with refi charges — and also you’re capable of finding a lender that waives most closing prices, a house fairness mortgage may very well be the suitable selection.

Price comparability: 15-year cash-out refi vs. 15-year house fairness mortgage

The desk under compares the prices of a cash-out refinance with that of a house fairness mortgage. On this situation, the refi comes out cheaper, regardless of its increased closing prices. It is because the cash-out refinance rate of interest is considerably decrease than the house fairness mortgage price’s.

15-year cash-out refi |

15-year house fairness mortgage |

|

|---|---|---|

| Mortgage quantity | $150,000 | $150,000 |

| Closing prices | $2,400 | $600 |

| Rate of interest | 5.5% | 7.25% |

| Month-to-month principal and curiosity | $1,225 | $1,369 |

| Complete price in first 24 months | $31,800 | $33,456 |

| Complete price in first 48 months | $61,200 | $66,312 |

| Complete price in first 60 months | $75,900 | $82,740 |

Backside line on cash-out refi vs. house fairness mortgage

If the cash-out refinancing vs. house fairness mortgage contest, keep in mind that each are strategic methods to entry the fairness you’ve constructed in your house. Nonetheless, you need to think about your monetary state of affairs, targets and the way you intend to make use of the funds to find out the very best strategy. It’s equally vital to think about the qualification standards for each choices to gauge which you’re more than likely to get authorised for.

All the time store round and evaluate presents from a number of lenders no matter which path you select. Additionally, request an itemized record of lending charges out of your lender earlier than committing, so you possibly can calculate how a lot the mortgage will price.

![Twitter's Google Rankings Plummet Following Actions By Elon Musk [UPDATED]](https://makefinancialcenter.com/wp-content/uploads/2024/07/img_2023-7-4-175042-64a4944b3e6ed-sej-150x150.jpeg)