Picture supply: Getty Pictures

It’s a easy incontrovertible fact that Brits aren’t setting apart sufficient cash to assist them fund their retirement. The rising price of dwelling means the quantity now we have to avoid wasting or make investments — resembling by shopping for UK progress and dividend shares — is on the decline.

Scottish Widows’ newest annual ‘Retirement Report’ underlines the size of the issue. After interviewing 5,072 UK adults, the pensions big stated that “38% of individuals at the moment are on observe for dwelling requirements in retirement under the minimal stage“.

That’s 3% increased than 2023’s survey. To place that in perspective, it means an additional 1.2m persons are on track to take pleasure in a sub-minimum way of life once they retire.

Right here’s my plan

So what would life like seem like underneath this life customary class? Scottish Widows’ has used the Pensions and Lifetime Financial savings Affiliation’s (PLSA) definition of the minimal dwelling customary, which for a single particular person permits for:

- £50 every week for groceries, and £25 a month for consuming out

- No automobile, and £10 every week for taxis and £100 a 12 months for trains

- Per week-long UK vacation annually

- A fundamental TV and broadband package deal

- £630 a 12 months to spend on clothes and footwear

To me, this can be a fairly chilling prospect. I don’t plan to spend most of my life working solely to then dwell on the breadline after I finally retire. I’m positive you are feeling the identical!

So I make investments as a lot as I can each month to attempt to construct a wholesome nest egg for retirement, even throughout this cost-of-living disaster. The sooner all of us start our journey, the higher.

However I imagine that high-yield dividend shares — just like the one described under — may assist even those that start investing later in life to take pleasure in a snug retirement.

7.2% dividend yield

Aviva (LSE:AV.) has one of many largest ahead dividend yields on the FTSE 100 right this moment. At 7.2%, it’s double the index common of three.6%.

Monetary providers companies will be weak throughout financial downturns when client spending falls. However because of its formidable money reserves, Aviva appears in good condition to proceed paying giant dividends for the foreseeable future.

Its Solvency II capital ratio was a powerful 206% as of March. This even allowed the enterprise to purchase again a whopping £300m of its shares earlier this 12 months.

I’m assured Aviva can have the means to steadily develop dividends over time, too. Demand for its pensions, financial savings, and safety merchandise ought to rise significantly because of beneficial demographic adjustments.

A £30k+ passive revenue

If I had £5,000 to spend money on Aviva shares, I may count on to make an annual passive revenue of £360 this 12 months. That’s based mostly on the corporate’s 7.2% dividend yield for 2024.

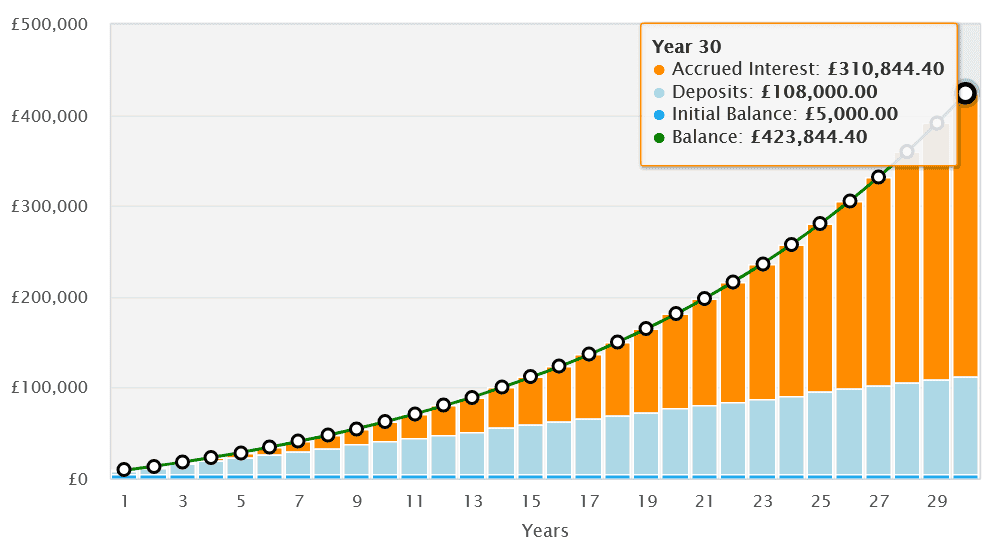

If dividends stay the identical together with the share value, my £5k lump sum would flip into £43,077 after 30 years with dividends reinvested. If I supplemented this preliminary funding with an additional £300 a month, I may flip this into £423,844 by 2049.

At this level I’d be incomes an annual passive revenue of £30,517. Mixed with the State Pension, this could possibly be greater than sufficient to permit me to retire in consolation.