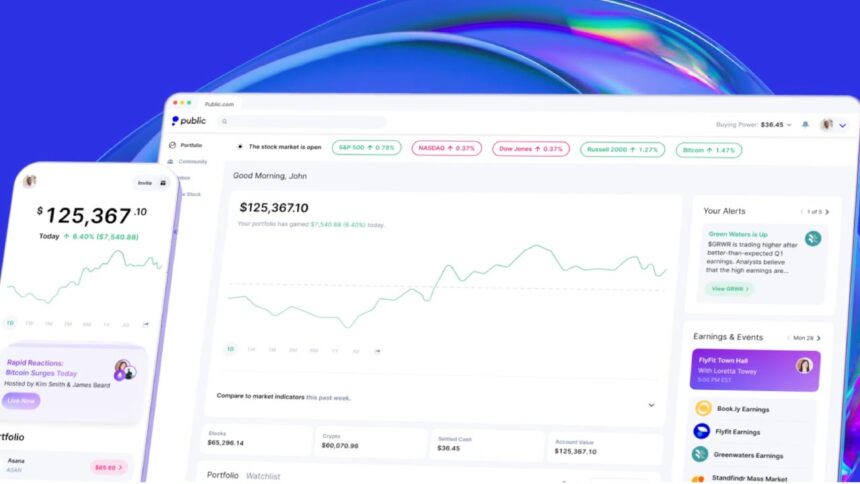

Public is an investing platform that provides a stable buying and selling expertise and can possible attraction to buyers who’re new to monetary markets. You’ll get entry to a lot of academic content material that may assist starting buyers rise up to hurry. And with fractional shares, you can begin buying and selling with as little as $1 with the Funding Plan function.

You additionally gained’t have to fret about commissions on shares, ETFs or choices, and it makes bond buying and selling far more accessible, too. Public affords cryptocurrency buying and selling — although there’s a transaction price charged by their crypto companion — in addition to the chance to put money into non-traditional property equivalent to luxurious items and up to date artwork. A social feed is on the market to attach with different buyers about commerce concepts and firm executives are generally accessible for investor questions via its “city corridor” conferences.

Whereas Public affords a lot of what’s going to curiosity a typical investor, you gained’t discover mutual funds on the app and particular person taxable accounts are the one account sort supplied. Traders in search of a broader brokerage providing ought to take into account conventional brokers equivalent to Constancy Investments or Charles Schwab.

Overview of Public

| Class | Public |

|---|---|

| Minimal steadiness | $0 |

| Securities tradable | Shares, ETFs, choices, cryptocurrency, bonds |

| Value per commerce | $0 |

| Customer support | E mail and chat |

| Account charges | $75 for transfers out; $3.99 inactivity price charged every month in case your account stays inactive for at the least six months with lower than $70 in your account |

| Cellular app | The Public cellular app is on the market on the Apple App Retailer and Google Play Retailer |

Finest for:

- Starting buyers

- Purchase-and-hold buyers

- Fractional shares

Professionals: The place Public stands out

Low commerce minimal and no commissions

Public makes it astoundingly simple to purchase into the market. You’ll want simply $1 to get into the sport. And also you’ll have entry to actually hundreds of shares and exchange-traded funds (ETFs), so that you’re more likely to discover that sizzling inventory you wish to purchase. Public actually can’t decrease the bar any additional to inventory possession.

As a part of its worth proposition, Public doesn’t cost any fee. Zero-commission buying and selling will not be fairly the hook that it was just a few years in the past when Robinhood began pulling this little trick. Nonetheless, it’s good to see that Public meets the usual business fee construction.

Wish to set your buying and selling on autopilot? Public helps you to arrange an funding plan to purchase shares or funds often so that you don’t want to fret about it. Premium members obtain this function at no further price, although non-paying members pays $0.49, $0.99 or $1.99, relying on the variety of shares of their funding plan (1-3, 4-10 or 11-20, respectively).

Choices pricing

Not solely does Public offer you entry to $0 choices, it affords income sharing on choices trades. Meaning purchasers can obtain 50 p.c of the dealer’s income on trades, although you’ll want to enroll in this system. The online impact implies that (extremely) it’s possible you’ll wind up being paid in your choices trades.

For instance, Public estimates that purchasers would obtain about $0.18 per contract traded and a web $0.15 per contract, after factoring in regulatory charges, that are assessed at each dealer. This pricing construction might properly make Public the most effective choices dealer on the market, amongst brokers providing free choices trades.

Bond buying and selling

Public started providing Treasury securities and company bonds in 2023, giving it a presence within the fixed-income world. Buying and selling particular person bonds is usually the province of extra refined buyers, partly as a result of it prices round $1,000 to purchase a single bond, making it prohibitive for a lot of particular person buyers. Public is altering that, and permitting buyers to purchase a way more manageable portion of a bond within the $100 vary, opening up the market to extra folks.

Public prices a price of $0.10 to $0.25 for each $100 face worth in Treasury bonds, whereas company bonds run $0.35 to $0.50 for each $100 in face worth. The bond market is much less liquid than the inventory market, leading to wider bid-ask spreads that may price buyers actual cash.

For buyers trying to additional diversify their bond holdings, Public affords a Bond Account that requires an preliminary $1,000 minimal deposit, permitting you to put money into a portfolio of 10 company bonds that lock in a set yield on the time of buy. Notice that the bonds supplied are of medium credit score high quality, which suggests there may be an elevated stage of default threat related to them in comparison with higher-rated choices. Traders ought to assess whether or not these bonds swimsuit their threat tolerance accordingly.

Fractional shares

Public permits fractional shares on its platform, and that’s an ideal function for novices. With fractional shares, you should buy a slice of even the highest-priced shares or ETFs. And with the low commerce minimal of simply $1 with the Funding Plan function, you may personal a chunk — albeit a tiny one — of something. This function will get each final greenback of your cash working for you, whatever the inventory value.

Not solely does Public help shopping for partial shares, however it additionally permits you to reinvest in them, too. So whenever you obtain a dividend, you may set the app to reinvest it into the inventory that paid it.

Each options are good for novices, and never many brokers supply each. In reality, Constancy, Charles Schwab and Robinhood are a number of the solely main on-line brokers that provide each options.

Intensive training and analysis

Public does a very good job of offering a plethora of academic content material for starting buyers, together with tons of “101” sort info on the investing fundamentals. So that you’ll be capable of learn clear articles that specify the fundamentals (“What’s a brief squeeze?” or “What causes market volatility?”).

You’ll additionally get an intensive information feed and analysis on any inventory that you simply wish to comply with in addition to important monetary info, upcoming earnings studies and message boards for every inventory. One other nice function: You’ll be capable of pay attention to every firm’s earnings calls (reside or pre-recorded) or learn a transcript of them proper from the app, going again 4 years. It’s a surprisingly detailed providing and compares properly to different prime buying and selling apps.

Social feeds

One of many extra uncommon — and fascinating — options of Public is the social feed that permits you to comply with different buyers, scan via featured profiles and interact in some inventory chat with them on the platform. So it’s not solely shares you may comply with, however folks, too. You’ll be able to see why one other investor likes a sure inventory and once they would possibly wish to purchase or promote it.

You too can search via thematically linked shares (“Dwelling & Backyard” or “Ladies in Cost,” for instance) to tug concepts after which see what different buyers suppose. And naturally, you may search for the day’s large movers and different comparable types of pre-screened shares.

One other cool function is what Public calls “city halls,” which is a type of question-and-answer session with CEOs of publicly traded corporations, maybe even certainly one of your holdings. You submit written questions and leaders reply to them in a reside discussion board.

Public Premium subscription

If you happen to’re in search of extra information, steerage and evaluation than what’s accessible on a inventory’s web page, Public additionally affords Public Premium, a subscription service that prices $8 monthly billed yearly (or $10 monthly billed month-to-month). That dough will get you extra monetary metrics to research the corporate in addition to different evaluation. You’ll additionally get an upgraded stage of buyer help from the Public group and the power to arrange an automated funding plan at no further price, as talked about earlier than.

Clients do have a approach to skip the $10 price, although. Merely have an account with $50,000 and Public offers you entry to Premium free of charge.

Entry to cryptocurrency

Along with shares and ETFs, cryptocurrency can be accessible on Public. The app affords seven of the most well-liked cash, together with Bitcoin, Ethereum and Shiba Inu. Plus, you may make investments as little as $1. Public’s companion Bakkt Crypto prices 1.25 p.c of the transaction worth above $500 and a sliding scale under that. And also you’ll additionally be capable of use the app’s social feeds to talk with others about all of it.

Cons: The place Public might enhance

Lack of mutual funds

If you wish to put money into shares and ETFs, like many buyers, you’ll discover what you’re in search of right here. Throw within the high-risk, high-return potential of choices, and this choice will suffice for a lot of buyers and perhaps most. These securities have sufficient threat and potential return — you may earn passable income with out different forms of investments.

However buyers in search of comparatively widespread decisions equivalent to mutual funds must arrange an account elsewhere. That’s the character of an app that pitches itself to teach novices on the right way to make investments.

That mentioned, Public does supply cryptocurrency buying and selling and entry to non-traditional property equivalent to wonderful artwork, NFTs, uncommon buying and selling playing cards, comics, music royalties and even uncommon sneakers. A strong providing in these classes makes Public principally not like any conventional on-line low cost dealer.

Restricted account sorts

You’ll have already got created your account earlier than you understand that you simply weren’t even requested for the account sort. That’s as a result of Public affords solely probably the most easy possibility right here: a person taxable account. That’s most likely not a dealbreaker for the viewers Public is trying to entice, however many others gained’t discover it to their liking and will ultimately go elsewhere. Traders trying to save for retirement via tax-advantaged accounts equivalent to conventional and Roth IRAs must open an account with one other dealer.

Backside line

With its give attention to training in an easy-to-use app, Public affords a stable bundle to novices within the investing sport:

- The tutorial and social parts will assist newer buyers interact with investing and supply them a purpose to return again to the app even when they aren’t buying and selling.

- Starting buyers ought to respect no account minimal, fractional shares and extra.

- These trying to commerce choices might discover the fee construction right here enticing and the entry to bonds at a decrease funding minimal might show interesting.

Traders in search of brokers with sturdy academic choices ought to take a look at Constancy, Charles Schwab and Merrill Edge. These needing extra forms of accounts might select nearly some other dealer, although a number of the bigger gamers equivalent to E-Commerce will present a wider choice.

— Bankrate’s Logan Jacoby contributed to an replace of this story.