Picture supply: Getty Pictures

The Self-Invested Private Pension (SIPP) is — just like the Particular person Financial savings Account (ISA) — an efficient product for constructing a pot of money for retirement.

Like a Shares and Shares ISA, any capital positive aspects or dividend revenue generated in a SIPP are shielded from the taxman. This gives traders with extra capital, and due to this fact the means for superior exponential progress by way of compounding.

However that’s not all. With tax reduction, SIPP traders additionally get tax reduction from the federal government with which to develop their portfolio.

Right here’s how even a 40-year-old with no financial savings or investments may probably construct a big retirement fund with a £500 month-to-month contribution.

Please be aware that tax therapy is dependent upon the person circumstances of every shopper and could also be topic to alter in future. The content material on this article is supplied for data functions solely. It isn’t meant to be, neither does it represent, any type of tax recommendation. Readers are accountable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

Tasty tax reduction

That £500 funding may not look like lots at first look. At £6,000 a 12 months, that is effectively under the present annual allowance on SIPPs. Most often, that is both £60,000 or a sum equal to a yearly revenue, whichever’s decrease.

However due to beneficiant tax reduction, the precise worth of those contributions will be significantly better.

Reduction is ready on the following charges:

- 20% for basic-rate taxpayers

- 40% for higher-rate taxpayers

- 45% for additional-rate taxpayers

So in impact, a basic-rate taxpayer is placing £625 into their SIPP every month by investing £500 of their very own money.

Increased-rate and additional-rate taxpayers get pleasure from the identical £125 month-to-month top-up straight into their pension. The rest is claimed again by way of self-assessment.

Investing correctly

A boosted month-to-month contribution is a big perk for SIPP customers. However as with every different monetary product, the quantity of wealth generated finally is dependent upon the best way they use their cash.

Buyers should buy all kinds of shares, trusts and funds with a SIPP. Or they will merely select to carry their cash in money.

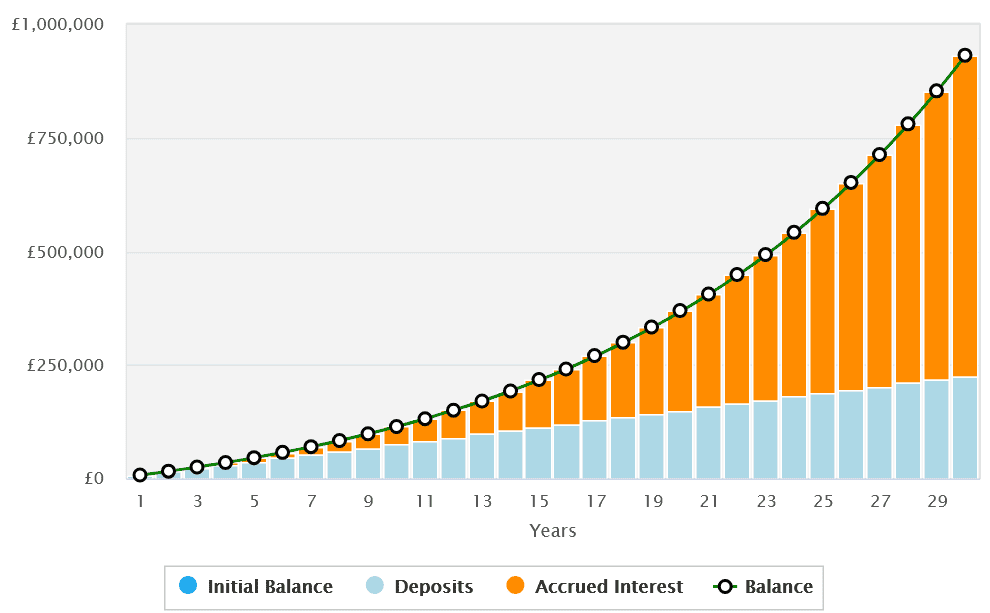

The distinction on long-term returns will be appreciable. Let’s say a basic-rate taxpayer was to get a mean 3.5% financial savings price on their money steadiness. Primarily based on a £625 month-to-month contribution they’d, after 30 years, have a pension price roughly £397,133.

Now let’s say they as a substitute bought shares that supplied a mean annual return of 8%. With the identical contribution over three many years they’d be sitting on a considerably greater sum of £931,475.

Getting began

There’s no proper and unsuitable approach to method SIPP investing. Your best option for every of us relies on our private funding targets and tolerance of threat.

However I consider these looking for to supercharge their retirement fund ought to think about investing in shares. Investing in a fund or a belief can scale back threat too by spreading capital throughout a basket of property.

The F&C Funding Belief‘s (LSE:FCIT) an asset that ticks loads of packing containers for me and could possibly be price additional analysis. Courting again to 1868, it has a protracted and distinguished document of delivering wholesome returns, together with 53 consecutive years of dividend progress.

In the present day, it holds shares in additional than 400 totally different international corporations unfold throughout a number of sectors. Main names embody chipmaker Nvidia , monetary providers supplier Mastercard, drugmaker Eli Lilly and retailer Costco.

This diversification doesn’t defend traders from disappointing returns throughout downturns. However over the long run it’s confirmed an efficient manner of balancing threat administration and optimising returns.

Since January 2015, the F&C Funding Belief’s supplied a mean annual return of 11.4%. If this continues (and that’s a giant ‘if’ because it’s not assured), contemplating a £625 month-to-month funding right here may assist traders construct a big SIPP lots before 30 years.