Picture supply: Getty Photos

I consider investing in FTSE 100 shares is a superb technique to construct long-term wealth. It’s why I proceed prioritising blue-chip shares from the Footsie index (together with a smattering of high FTSE 250 shares).

Investing in shares could be a wild journey when information circulate adjustments and investor confidence sinks. However over the long run it could possibly present life-changing wealth in retirement.

And following recent analysis on how a lot cash I might have as soon as I end work, my technique of investing any additional money I’ve has taken on better significance.

£738k pension pot

As I’ve beforehand reported, the Pensions and Lifetime Financial savings Affiliation (PLSA) final week upgraded its forecasts for a way a lot the typical single Brit might want to retire comfortably. Its newest estimates could be seen beneath:

| Way of life | Former forecast | New forecast | YOY change |

|---|---|---|---|

| Minimal | £12,800 | £14,400 | + £1,600 |

| Reasonable | £23,300 | £31,300 | + £8,000 |

| Snug | £37,300 | £43,100 | + £5,800 |

To not be outdone, monetary companies supplier Quilter additionally raised its estimates on the dimensions of the pension pot the typical single particular person will want for a cushty way of life in retirement.

The brand new determine stands at an eye-popping £738,000. That’s up a whopping £100,000 from Quilter’s earlier forecasts.

Jon Greer, head of retirement at Quilter, stated that the PLSA’s newest forecasts present that it “will take a concerted effort to attain a pension pot required to fulfill the distinction between the [required income level] and that offered from the complete State Pension“.

Hitting the goal

The precise quantity wanted to retire differs from particular person to particular person. However that analysis gives a helpful information for all of us. And it clearly makes for sobering studying.

Nevertheless, I’m not letting panic take over. By beginning my funding journey early and often shopping for FTSE 100 shares, I’ve a very good probability of hitting that focus on laid down by Quilter.

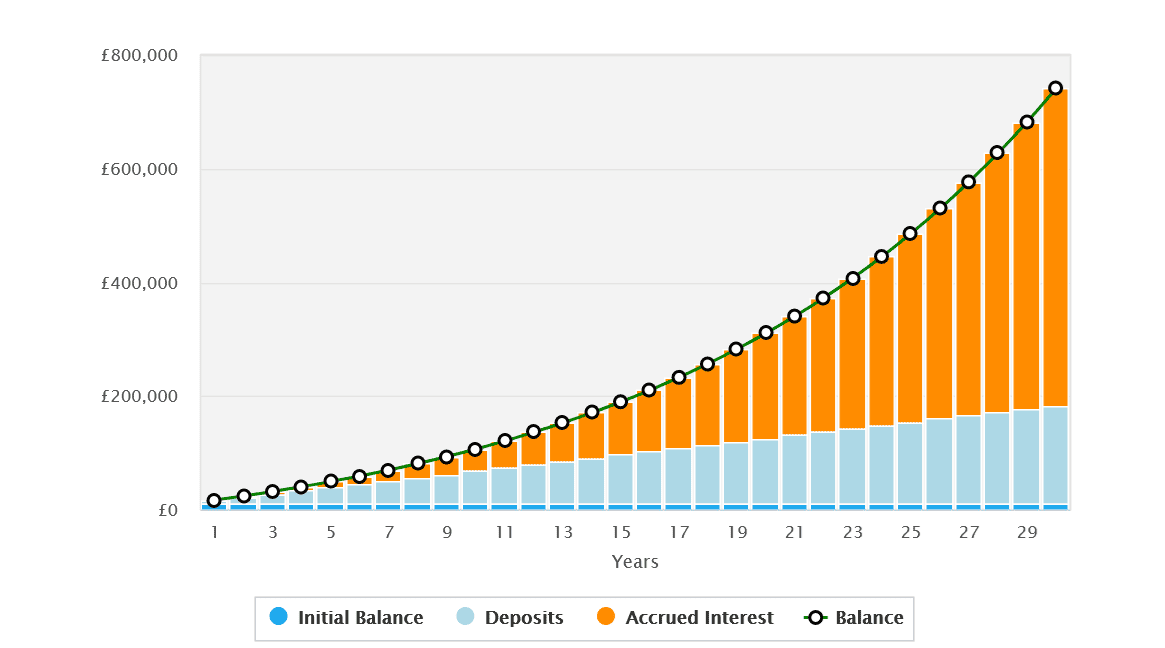

The UK’s premier share index has delivered a median annual return of seven.5% since 1984. If this pattern continues, after 30 years I might — with an preliminary funding of £10,000 and an everyday month-to-month funding of £480 — create that pension pot that Quilter recognized.

A high FTSE 100 inventory

Previous efficiency shouldn’t be a dependable information of what I can anticipate. However the Footsie‘s glorious long-term returns present what I may doubtlessly obtain over the long run.

And by constructing my portfolio round strong, multinational firms with robust stability sheets, I can increase my probabilities of hitting my retirement objectives. We’re speaking about companies like Reckitt (LSE:RKT), which owns main shopper healthcare manufacturers like Strepsils lozenges and Durex condoms.

Regardless of the issue of rising prices, this Footsie share nonetheless has an distinctive file of rising earnings with its well-liked labels. And it has appreciable monetary clout that it could possibly use for advertising and product innovation to maintain gross sales rising.

Reckitt additionally has vital publicity to fast-growing rising markets that it could possibly leverage to generate long-term earnings development. By surrounding these kinds of shares in my portfolio with some high-risk, high-reward FTSE shares, I feel I’ve a terrific probability of having fun with reaching a cushty way of life once I retire.