The Shopper Monetary Safety Bureau (CFPB) is a federal regulatory company established in 2010 as a response to the 2007-2008 monetary disaster. The CFPB implements and enforces Federal shopper monetary legislation in an effort to make sure that “markets for shopper monetary merchandise are honest, clear, and aggressive,” in response to the company’s web site.

Amongst different issues, the CFPB supervises banks and credit score unions with property over $10 billion, fining these establishments when the company finds authorized violations. Notably, the CFPB takes motion in opposition to monetary establishments for charging unlawful junk charges and opening accounts with out shopper consent.

As a latest instance, the CFPB fined fintech firm Chime greater than $4.5 million for illegally delaying shopper refunds previous the promised 14-day timeframe.

What are you able to do earlier than submitting a CFPB grievance?

Shoppers needn’t attain out to the corporate they’re having bother with previous to submitting a grievance, however it may be a useful first step, in response to Darian Dorsey, the CFPB deputy affiliate director of Shopper Response and Schooling.

“Typically firms can reply questions distinctive to your scenario and the services and products they provide,” Dorsey mentioned. “They can give you solutions or resolutions, saving you the additional step of submitting a grievance.”

However when you discover the corporate to be unresponsive or uncooperative, then you may transfer on with submitting a CFPB grievance.

Which services and products can customers complain about?

In an effort to search out violations, the CFPB permits customers to file complaints for hurt brought on by unfair, misleading or abusive practices, together with in opposition to a financial institution or credit score union. Services and products shopper can complain about embrace:

- Checking and financial savings accounts

- Bank cards

- Debt assortment

- Mortgages

- Pupil loans

Should you consider you’ve been topic to unfair, misleading or abusive practices by a monetary firm, right here’s how one can file a CFPB grievance.

The place do you file a CFPB grievance?

The CFPB’s web site features a devoted submitting web page the place you’ll find the portal to submit a brand new grievance, along with assets detailing what needs to be included within the submitting.

You’ll first must create an account with the CFPB earlier than you may proceed with submitting. You’ll must submit your identify, e mail deal with, cellphone quantity and create a password. After verifying your e mail, you can begin the submitting course of.

A step-by-step information to submitting a CFPB grievance

Step 1

The primary a part of the submitting is guided. You’ll have a number of choices to select from to point what your grievance is about. In the 1st step, you’ll select which services or products greatest matches your grievance.

This may very well be, for instance, a couple of deposit account resembling checking, financial savings or certificates of deposit. Or you could possibly select mortgages, which would come with such merchandise as standard house loans or house fairness loans or line of credit score (HELOC).

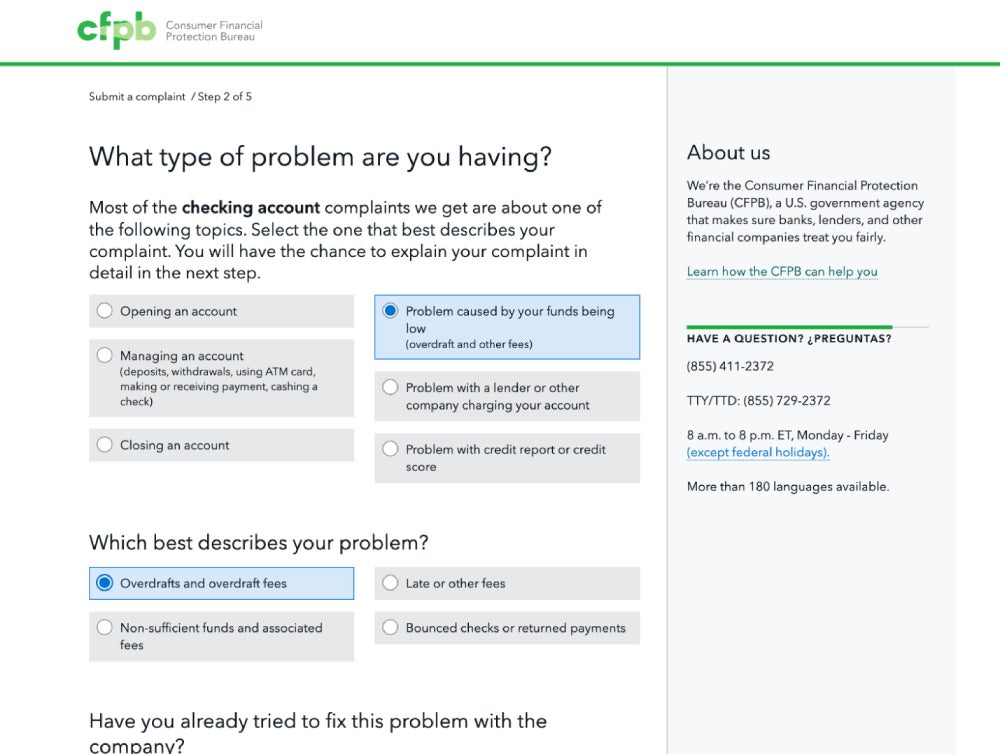

Step 2

In step two, you’ll point out which downside you’re having. For instance, when you’re having bother with overdraft charges, you’d first choose “downside brought on by your funds being low” after which choose “overdrafts and overdraft charges.”

At this stage, you may also point out whether or not you’ve reached out to the respective firm concerning the challenge you’re having. Should you’ve already reached out to the corporate, you may point out what data you requested from them within the grievance.

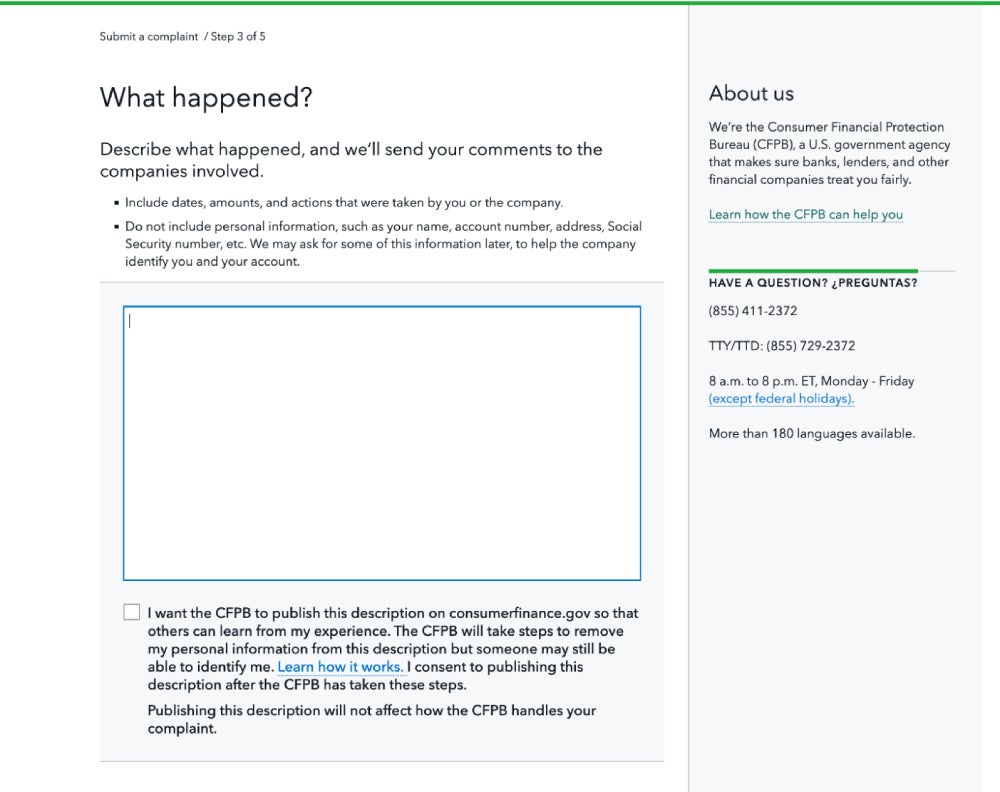

Step 3

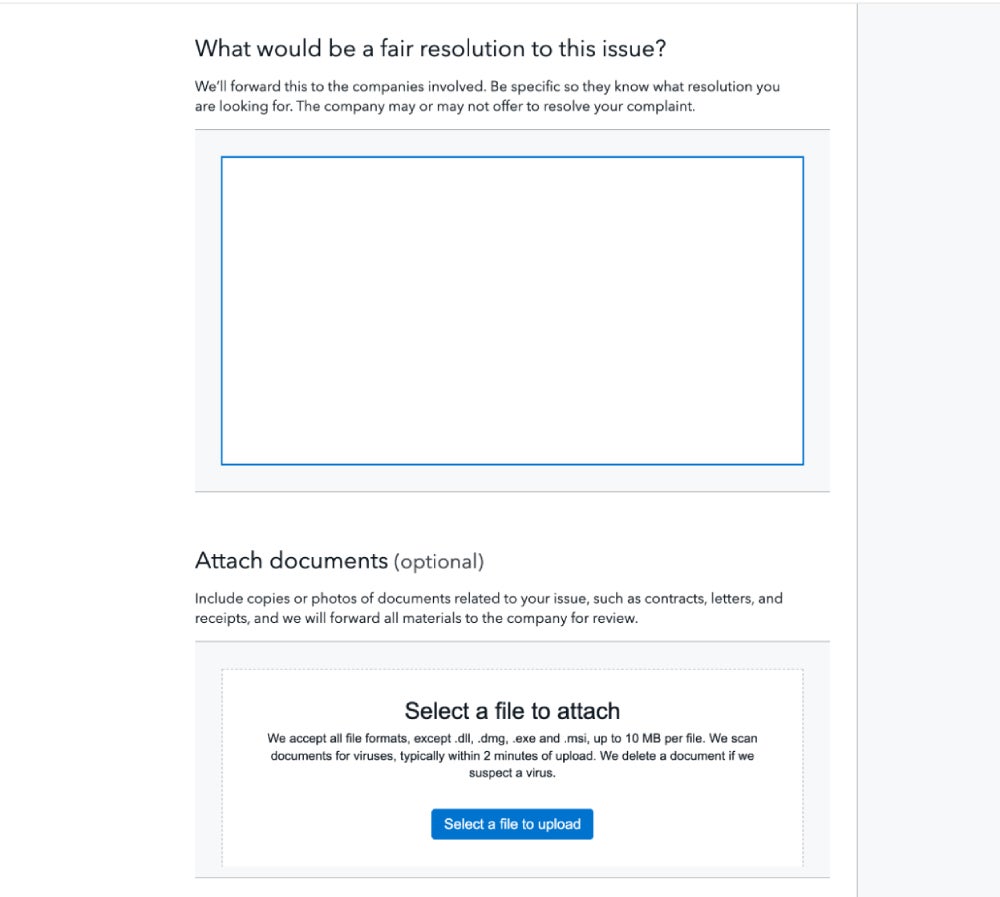

In step three, you’ll have the ability to write immediately right into a textual content field to explain what occurred. You’ll additionally have the ability to point out what you consider can be a good decision to the difficulty you’re having. You can even connect any paperwork that may assist your declare (the restrict is 50 pages).

“If a shopper is in search of an apology, they will add that into the grievance,” Dorsey mentioned. “Or perhaps they need a refund of a late charge. This part permits firms to tailor their response with what a shopper is definitely asking for.”

Be sure you embrace an important dates, greenback quantities and communications you’ve had with the corporate you’re complaining about.

As a result of you may’t file about the identical grievance greater than as soon as, filers are inspired to “arrange their ideas and the problems they’re having in order that the corporate is responding to probably the most thorough description of the difficulty and the influence to the buyer,” Dorsey mentioned. “This manner, customers get the very best probability at a response from the corporate that solutions their points.”

At this step, you’ll additionally have the ability to point out whether or not you’re OK with the CFPB publishing the outline of your grievance to its web site. (The CFPB will take steps to take away your private data, so as to’t be recognized.)

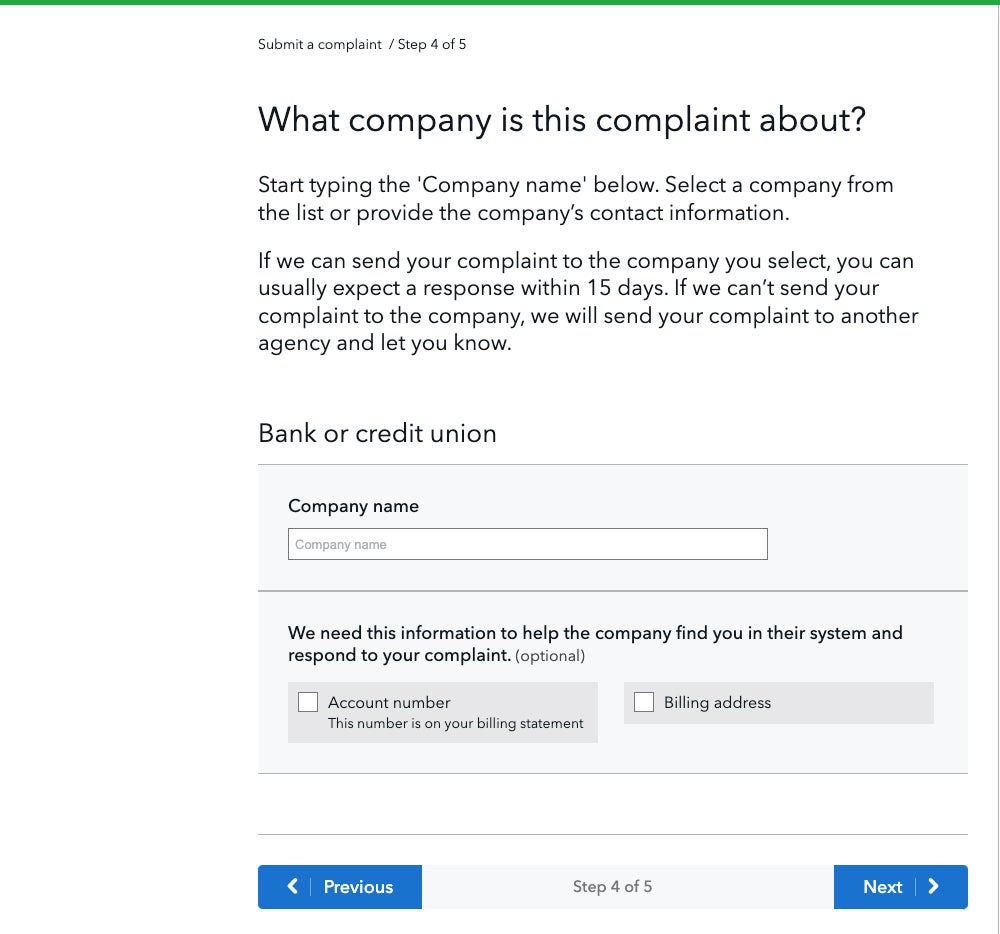

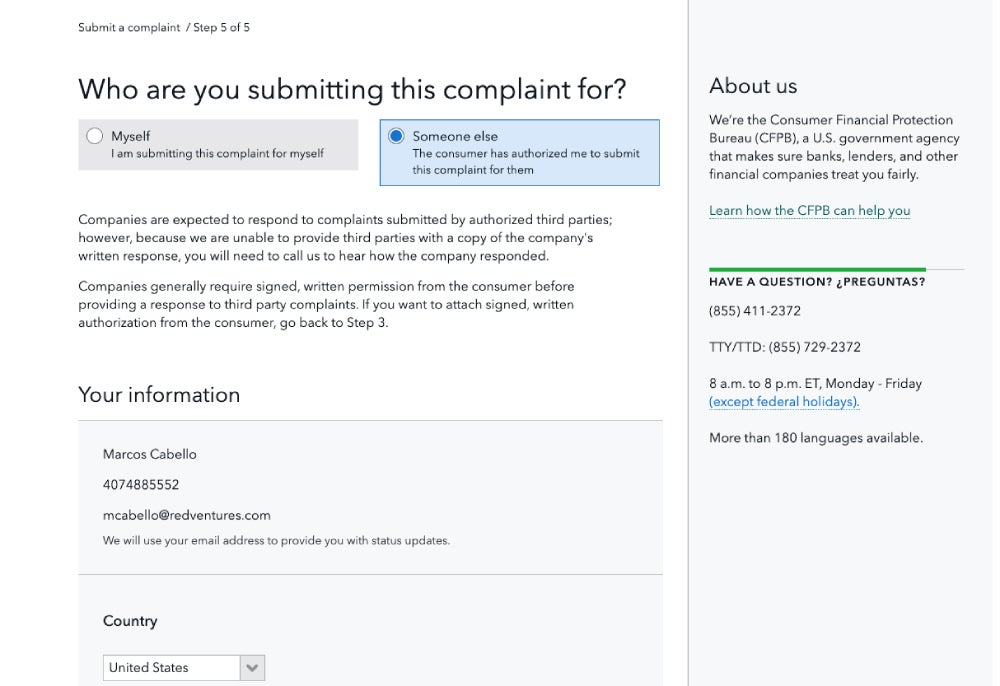

Steps 4 and 5

And lastly, in steps 4 and 5, you’ll point out which firm you’re having an issue with and point out who you’re submitting this grievance for (your self or for another person). You’ll then have the ability to add your private data.

Should you’re complaining a couple of financial institution, you’ll have the choice to incorporate particular details about your account, together with your billing deal with and account quantity.

What occurs after submitting a CFPB grievance?

After receiving your submitting, the CFPB will ship your grievance to the related firm, which is able to overview the problems raised.

Firms sometimes reply inside 15 days, although some firms take as much as 60 days to supply their last response. Within the latter case, the corporate will sometimes acknowledge your grievance is in progress earlier than offering you with a last response.

After the corporate responds, you’ll have 60 days to supply suggestions by a post-complaint survey, which might be forwarded to the corporate. Sadly at this stage, that’s the top of the street for filers — whether or not or not you might be happy with the decision.

“Firms make their very own enterprise selections about what’s required of them: what’s inside their authorized and compliance necessities and what suits with their enterprise practices,” Dorsey mentioned. “However shopper complaints come collectively to tell the CFPB’s broader work, particularly in terms of enforcement.”

Backside line

Should you’re having points with a monetary service supplier – be it with overdraft charges, a HELOC or pupil loans – submitting a grievance with the CFPB will help you get to a decision. It could be price trying to work the issue out with the corporate first, however that isn’t a requirement to submit a CFPB grievance. And if the decision isn’t passable, you may point out so within the post-complaint survey, which the CFPB supplies on to the establishment in query.