Picture supply: Getty Pictures

The Shares and Shares ISA is an efficient methods to focus on a retirement earnings over time. The annual £20,000 funding allowance is greater than sufficient for the overwhelming majority of Britons. With them, not a single penny is due in tax on any capital good points an investor makes, or on dividends they obtain.

This provides people extra monetary firepower to develop their wealth over time. However how massive would somebody’s ISA must be to generate a gradual passive earnings of £20,000 a yr?

Please observe that tax remedy depends upon the person circumstances of every consumer and could also be topic to vary in future. The content material on this article is supplied for info functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation. Readers are answerable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding selections.

Constructing that ISA

To succeed in this purpose, people have a variety of choices. Three of the most well-liked are:

- To purchase an annuity that delivers a assured earnings for all times

- To take a position the pension pot in high-yield dividend shares

- To attract down a set share of their portfolio a yr

An alternative choice is to mix a number of of those decisions. As an example, somebody may use half their ISA to purchase an annuity for peace of thoughts, and to place the remaining in dividend-paying shares. The latter route carries extra uncertainty, however it may possibly additionally ship a better earnings whereas additionally leaving scope for portfolio development.

The dimensions of the nest egg some wants for a £20k annual earnings would differ relying on the technique they selected. However how massive would they want in the event that they selected to go down the drawdown route?

Let’s say we now have a retiree who needs to withdraw 4% of their portfolio every year. At this charge, they may count on a daily passive earnings for about 20 years earlier than the pot runs dry.

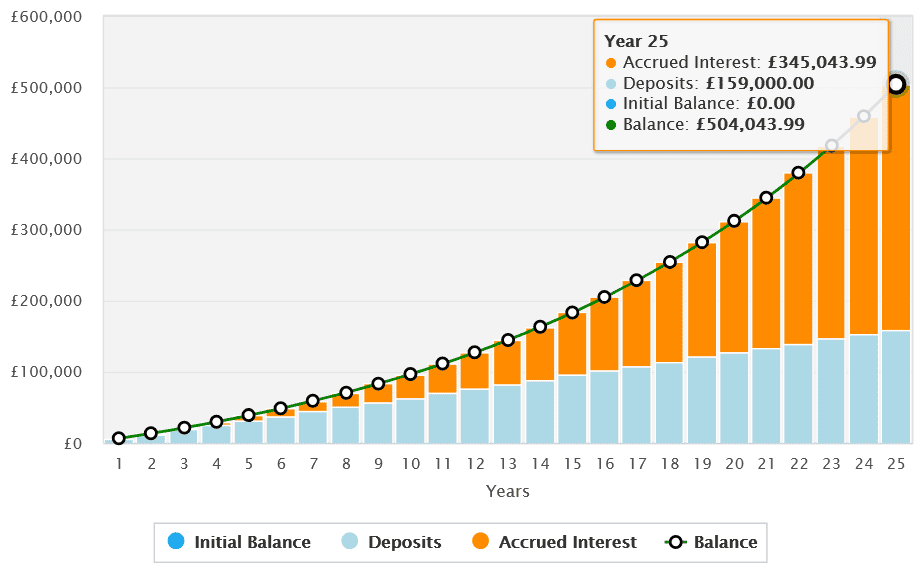

To realize this stage of earnings, they would wish a pot price £500,000. On paper, that appears like an enormous quantity. However with a tax-efficent Shares and Shares ISA — together with a dedication to common investing — it’s greater than attainable.

Investing £530 a month over 25 years at a median yearly return of 8% may construct a portfolio of this dimension, though this isn’t assured.

Diversifying to construct wealth

Immediately, ISA traders have 1000’s of UK and abroad shares to think about to focus on that kind of return. In addition they have a plethora of funding trusts and exchange-traded funds (ETFs) to assist them attain their objectives.

Funds just like the iShares FTSE 250 (LSE:MIDD) are easy and low-cost methods to construct a diversified portfolio. And this one, which offers publicity to all the UK mid-cap index, permits traders to unfold threat throughout a wide range of sectors and several types of shares (specifically development, dividend and worth shares).

A few of the ETF’s largest holdings are luxurious vogue home Burberry, precision instrument maker Spectris and on-line dealer IG.

Returns may disappoint throughout broader financial downturns, as they’ve in earlier years. But over time, it’s proved a resilient solution to construct wealth. Since its creation 21 years in the past, this iShares ETF has delivered a median annual return of 8.6%. If this continues, our investor placing £530 right here every month may obtain their £20k annual earnings sooner than deliberate.

Previous efficiency is not any assure of future returns. However I’m optimistic a nicely diversified portfolio — whether or not by a fund or belief like this, or by shopping for particular person shares — may set traders up for a wholesome retirement earnings.