Picture supply: Getty Pictures

The Self-Invested Private Pension (SIPP) is a strong weapon in constructing long-term passive revenue. Just like the Shares and Shares ISA, people don’t need to pay a penny in capital features or dividend tax on their funding returns, giving them extra monetary firepower to develop their wealth.

However that’s not all. With certainly one of these merchandise, buyers get pleasure from tax reduction of between 20% and 45%, relying on their private revenue tax bracket. This may be particularly priceless for individuals who don’t have giant lump sums to speculate, or who can’t make substantial common contributions.

Please observe that tax therapy relies on the person circumstances of every shopper and could also be topic to alter in future. The content material on this article is supplied for info functions solely. It isn’t supposed to be, neither does it represent, any type of tax recommendation. Readers are answerable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

With on a regular basis dwelling bills rising, and social care prices rising much more sharply, these monetary merchandise have gotten ever extra necessary. However how a lot passive revenue would somebody want from their private pension to retire comfortably?

£2,661 a month

The reply to this query relies on every of our particular person circumstances and plans for retirement. However utilizing the UK common laid down by Pensions UK (previously the Pensions and Lifetime Financial savings Affiliation) is an efficient place to start out.

It believes the common single particular person wants a complete revenue of £43,900 every year for a snug retirement. That quantities to simply below £3,659 a month.

With the present State Pension set at £11,973 per 12 months — or £998 a month — that leaves a shortfall of £31,927 that must be made up by a SIPP or different private financial savings or investing product. That’s simply over £2,661 a month.

Producing a pension revenue

There’s a number of methods to make use of a pension to make a second revenue in retirement. These embrace common drawdown, buying an annuity, and shopping for dividend-paying shares.

My very own plan is to purchase high-yield dividend shares. It’s a technique that would present me an revenue for all times, in contrast to utilizing a set-percentage drawdown from my retirement pot. And would additionally depart scope for additional portfolio progress over time.

If I purchased 6%-yielding revenue shares right this moment, I’d want £533,000 in my SIPP to offer me that month-to-month revenue of £2,661.

That’s not small change. However by committing to repeatedly investing, over time this objective may be very achievable.

Smashing the goal

One fast and easy approach is by shopping for an exchange-traded fund (ETF) just like the iShares FTSE 250 (LSE:MIDD) product. Holding this explicit fund leverages the distinctive progress potential of UK mid-cap progress shares. And with holdings in a whole bunch of various shares spanning a number of industries, it does so in a low-risk approach.

Main holdings right here embrace recovering luxurious good retailer Burberry and monetary providers supplier Aberdeen.

There have been bumps alongside the way in which, as — like different equity-based funds — it may fall in worth throughout broader inventory market downturns. However the glorious long-term returns communicate for themselves.

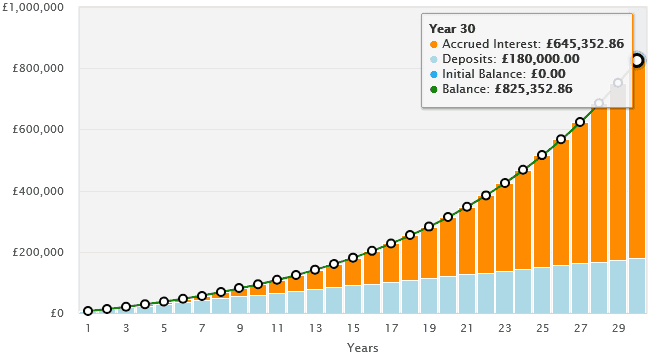

Since its creation in 2004, this FTSE 250 tracker’s supplied a mean annual return of 8.5%. If this continues, somebody who invested £500 every month right here in a SIPP (by way of a comination of private contributions and tax reduction) would have £825,353 of their pension pot after 30 years.

That’s properly above our £533,000 goal, and would give loads of flexibility for rising dwelling and social care prices three many years from now.

Previous efficiency isn’t any assure of future returns. However historical past exhibits {that a} diversified pension together with funds like this actually can ship a snug retirement.