Picture supply: Getty Photos

With shelter from capital revenue and dividend taxes, the Self-Invested Private Pension (SIPP) is usually a actual recreation changer for focusing on a long-term passive revenue.

On this respect, it is similar to the Shares and Shares ISA. Nevertheless, this monetary product has an added bonus: tax aid, which is paid on the following charges:

- 20% for basic-rate taxpayers

- 40% for higher-rate taxpayers

- 45% for additional-rate taxpayers

These tax financial savings and tax aid give share buyers an unimaginable benefit to construct wealth. With extra capital to take a position, people can pace up the compounding course of and develop their wealth sooner over time. An added bonus is that 25% of the SIPP can ultimately be withdrawn freed from tax.

Please notice that tax therapy is dependent upon the person circumstances of every consumer and could also be topic to vary in future. The content material on this article is supplied for data functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation. Readers are accountable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

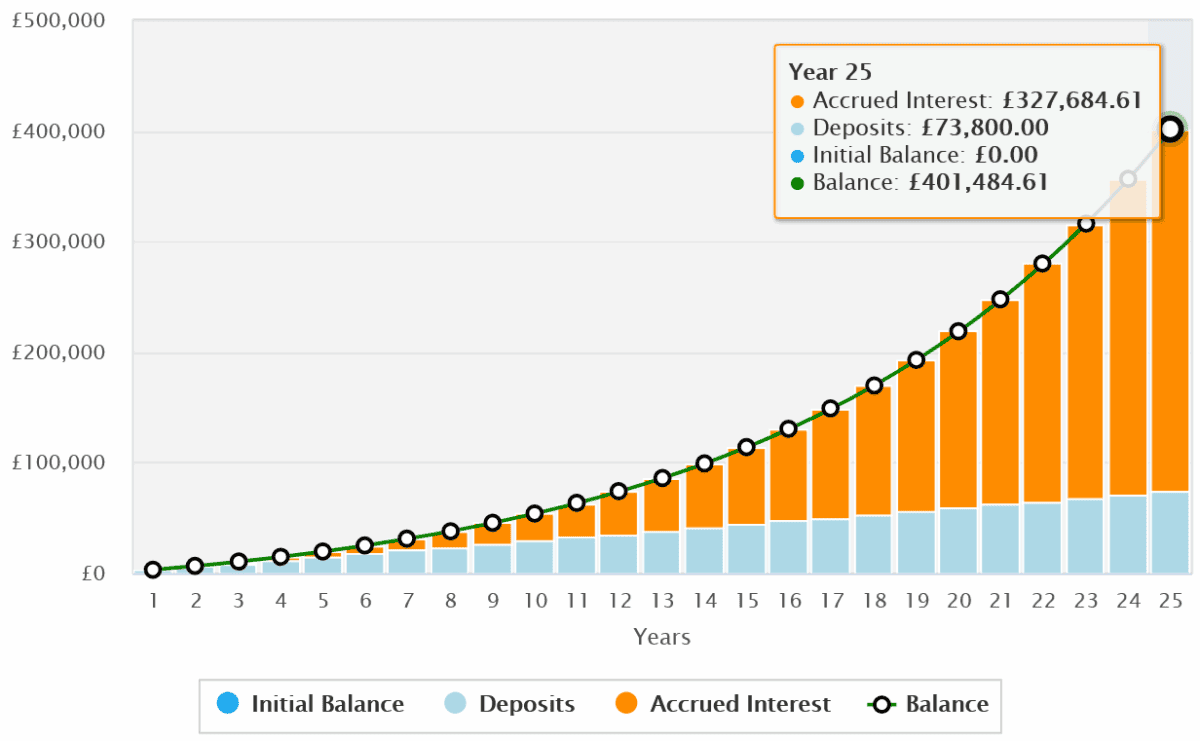

Put merely, this implies somebody who invests lower than £250 a month might realistically purpose for a £2,000 month-to-month second revenue by the point they retire.

Focusing on a £400k pension

A preferred passive revenue technique with SIPP customers is to spend money on dividend-paying shares.

An investor taking place this route would wish a pension pot of £400k for an revenue of £2k a month. That’s assuming they spend money on 6%-yielding dividend shares. Larger-yielding shares are generally accessible that might scale back the wanted pot dimension. However these shares might be riskier resulting from points like sector focus, decrease progress potential, and steadiness sheet instability.

Share buyers have many choices accessible to them to focus on this £400,000 portfolio. I personally like the thought of investing in a variety of worldwide shares, which offers large-range progress and revenue alternatives. On the similar time, this diversified method additionally lets me unfold danger.

By holding a basket of shares that replicates the MSCI World Index, a person might goal that £400k SIPP with a month-to-month funding of just below £250 (£246) over 25 years. That determine consists of tax aid, too.

This calculation relies on the index’s 10-year common annual return of 11.2%.

Utilizing world funds for a SIPP revenue

The MSCI World Index consists of 1,322 totally different corporations. Clearly, including this variety of shares right into a SIPP would require appreciable effort and value. Many of those shares can be unavailable to private pension buyers too. So this method is clearly off limits.

Fortunately, although, buyers can goal the index with the assistance of an exchange-traded fund (ETF). The iShares Core MSCI World Index (LSE:IWDG) — launched in 2017 — is one such funding automobile.

Monitoring errors are widespread with ETFs, reflecting small gaps between the fund’s efficiency and that of the underlying index. These replicate objects like dealing costs, commerce timings, and dividend reinvestment.

Nevertheless, well-managed funds considerably scale back (if not solely remove) the specter of broad divergences. This iShares one has a three-year monitoring error of simply 1.42%, in line with Morningstar.

Whereas properly diversified by sector and nation, I just like the fund’s excessive weighting of expertise shares (26.7% of the entire portfolio). Shares like Nvidia and Microsoft have important progress potential because the digital financial system quickly expands.

Previous efficiency isn’t a assure of future returns. However I really feel SIPP buyers searching for a big revenue ought to severely think about world share ETFs like this one.