Picture supply: Getty Photographs

Final 12 months, there have been 4,000 Shares and Shares ISA millionaires within the UK. And the quantity’s anticipated to continue to grow as individuals get financially savvier and search for higher returns than these from conventional financial savings accounts.

However how a lot does a investor want to take a position to construct a magic million-pound portfolio?

The magic quantity

The reply to this isn’t a easy one. It is determined by quite a lot of elements, together with the speed of return I’m in search of. The next return of, say, 12% will imply I don’t have to take a position as a lot. However concentrating on a bigger return additionally means I’ll usually be taking a much bigger danger with my money.

However as a way to get an thought, let’s use the typical return that Shares and Shares ISA traders have loved over the previous decade. This stands at 9.64%, based on monetary companies supplier Moneyfarm.

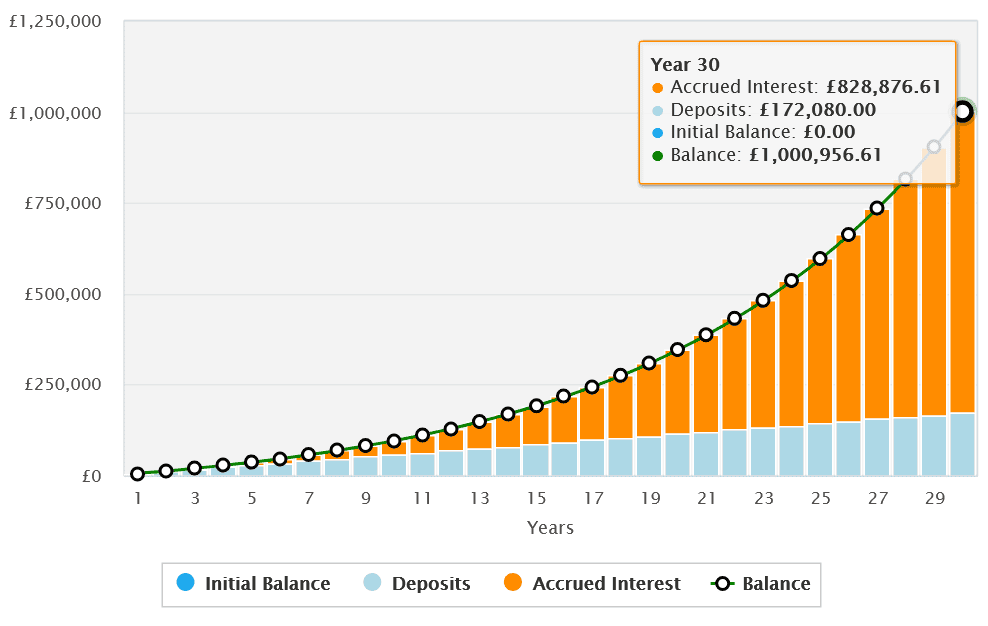

If I used to be trying to attain millionaire standing after 30 years of investing, I’d want to take a position precisely £478 every month primarily based on this determine. A breakdown of whole deposits and earned curiosity over the interval will be seen under.

Tax increase

Previous efficiency isn’t any assure of future returns, after all. I’ll discover myself making a sub-9.64% return over the long run. Expectantly, I’ll even beat that determine.

However I’m boosting my possibilities of hitting that million-pound goal right away by utilizing a Shares and Shares ISA. This manner I don’t must pay the taxman a penny on any capital features or dividends I obtain.

Over time, this will add as much as a major chunk of money. Asset supervisor Netwealth reckons a further price taxpayer investing £100,000 in an ISA would save £44,000 in taxes over a decade. That’s primarily based on a 5.9% common annual return, and excludes dealer charges.

Please be aware that tax remedy is determined by the person circumstances of every consumer and could also be topic to vary in future. The content material on this article is supplied for data functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation. Readers are liable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding selections.

Two prime ideas…

There are different vital issues I can do to attempt to attain millionaire standing. One is to reinvest any dividends I obtain, permitting me to earn cash on this ‘curiosity’ alongside my preliminary capital.

As I purchase increasingly shares, which in flip offers me an growing variety of dividends, a snowball impact’s created that may supercharge the dimensions of my portfolio over time. This mathematical miracle is named compounding.

The opposite factor I’d do is spend money on a variety of shares, exchange-traded funds (ETFs), and different belongings. Spreading my cash throughout asset courses, sectors, and geographies offers me publicity to completely different funding alternatives and in addition spreads danger.

… and one nice ETF

A fund just like the iShares Edge MSCI USA High quality Issue UCITS ETF (LSE:IUQA) may assist me obtain this in a straightforward and cost-effective method. This specific product invests in 125 US firms which have nice information of producing sturdy and secure earnings.

Main names it holds embody microchip producer Nvidia, prescription drugs large Eli Lilly, retailer Costco and bank card supplier Visa.

Its slim concentrate on US shares may create issues if sentiment in direction of the Stateside inventory market deteriorates. However, on stability, I believe it’s nonetheless value an in depth look.

This high quality issue fund’s delivered a mean annual return of 14.39% since its inception in 2016. If this continues, a £478 month-to-month funding right here may assist me hit millionaire standing a lot sooner.

![10 Creative Infographics & Why They Work [With Examples]](https://makefinancialcenter.com/wp-content/uploads/2025/10/image-for-guest-article-SEJ_1600x840_-1-150x150.png)