Picture supply: Getty Photos

For me, one of the best ways to focus on a sizeable passive earnings in retirement is with a Self-Invested Private Pension (SIPP). I’m not trying to attract down any cash earlier than the age of 57, so I don’t have to fret about any early withdrawal penalties.

I additionally get to take pleasure in a beneficiant annual allowance that towers above that of the Shares and Shares ISA. This variable determine is equal to a person’s yearly earnings, as much as a most of £60,000.

Large advantages

The principle benefits of utilizing a SIPP to construct long-term wealth are twofold. Like a Shares and Shares ISA, traders don’t pay a penny in tax on capital good points and dividend earnings. This frees up additional cash for funding, enhancing the compounding impact and constructing wealth sooner.

Along with this, people obtain extra cash to put money into the type of tax reduction. This can be a luxurious that ISA traders don’t get to take pleasure in, and is about on the following charges:

- 20% for basic-rate taxpayers.

- 40% for higher-rate taxpayers.

- 45% for extra charge taxpayers.

Please word that tax remedy depends upon the person circumstances of every shopper and could also be topic to vary in future. The content material on this article is supplied for data functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation. Readers are chargeable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding selections.

Focusing on a £1m+ portfolio

Let’s see how this works in observe. We’ll use the instance of Steve, a higher-rate taxpayer who has £500 of his personal money to speculate every month in a portfolio of UK and worldwide shares.

He receives 20% basic-rate tax reduction at supply, which routinely will increase his month-to-month contribution to £625. Steve also can declare one other 20% via his tax return, including one other £125 and taking his whole month-to-month contribution to £750.

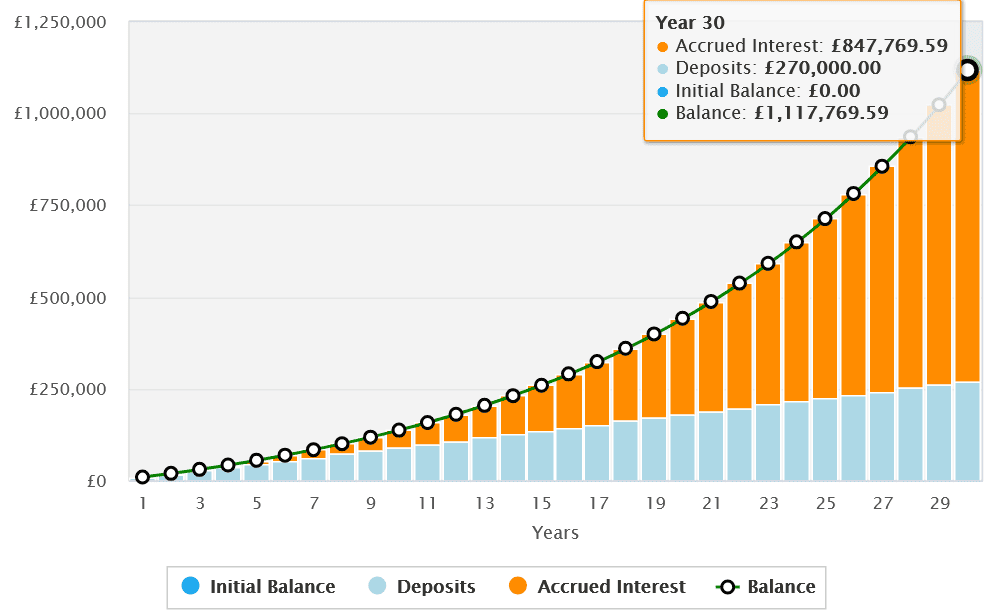

Now let’s say Steve invests for 30 years and achieves a mean annual return of 8%. At this charge he’d develop his retirement pot to greater than £1.1m.

With out this tax reduction, Steve’s retirement fund could be far decrease, at £745,179.

On the draw back, SIPP traders do need to pay tax after they draw down money, in contrast to ISA customers. Nevertheless, they’ll take as much as 25% of their pot tax-free at retirement. Mixed with that beneficiant tax reduction, this could nonetheless depart traders in a stronger place total.

Harnessing US shares

One other benefit is that traders can select from all kinds of UK and abroad shares, funding trusts and funds of their SIPP to develop their wealth.

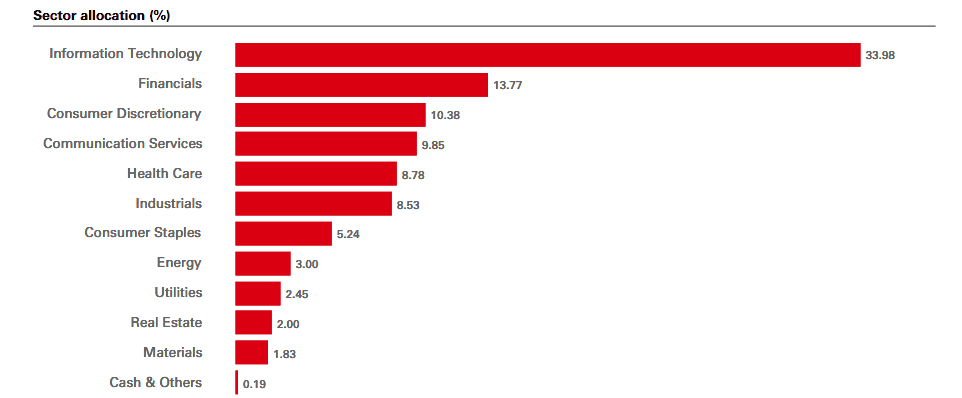

The HSBC S&P 500 ETF (LSE:HSPX) is one such asset I maintain in my very own portfolio. During the last decade it’s delivered a mean annual return of 13.3%. That is thanks partially to its giant contingent of high-growth tech shares like Nvidia, Microsoft, Apple and Amazon:

As you may see, although, it additionally supplies huge publicity to quite a lot of completely different industries, permitting traders to harness the wealth-growing energy of the US inventory market. Such diversification additionally permits traders to successfully unfold threat and luxuriate in a smoother return throughout the financial cycle.

Rotation out of US shares has impacted the fund’s efficiency extra lately. Whereas nonetheless a threat, I imagine that on stability it should — together with my different SIPP holdings — considerably enhance my probabilities of making a big retirement earnings. It’s one to think about.