Picture supply: Getty Photos

Making hundreds of thousands within the inventory market is perhaps extra achievable than you assume. Many Shares and Shares ISA traders have constructed seven-figure balances for the reason that tax-efficient product launched in 1999.

In line with HM Income and Customs, there have been 4,070 ISA millionaires as of April 2021. The info, which adopted a freedom of knowledge (FOI) request by Openwork Partnership, additionally confirmed that the highest 50 ISA traders had a median steadiness of £8.5m.

Making a fortune on the inventory market isn’t straightforward. Only a fraction of ISA traders have managed to make a magic million. However this research by interactive investor may present me what I need to do to get a spot on millionaire’s row.

The wealthy record

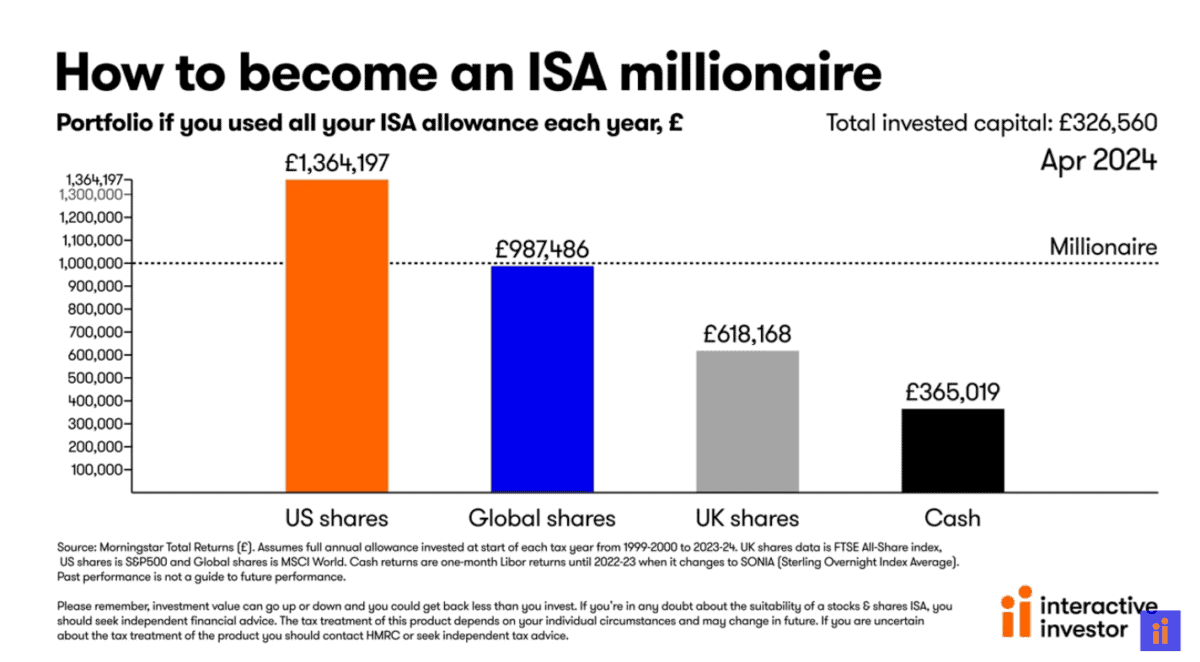

Analysts on the brokerage have crunched the numbers on the returns ISA traders would have made between April 1999 and April 2024 throughout 4 asset courses:

- US shares

- World shares

- UK shares

- Money

The mannequin assumes that traders would have maxed out their annual allowance yearly and excludes the influence of buying and selling charges. Listed below are the outcomes:

US shares cleared the path

As you possibly can see, those that purchased US shares would have been the most important gainers over the previous 25 years, reaching an ISA pot above £1.3m.

Subsequent can be traders who purchased world shares, constructing a nest egg simply shy of one million. UK share traders are available third place with a remaining sum of £618,168.

ISA traders who simply held their cash in money would have been the worst performers. They’d have made a revenue of lower than £40,000 on a complete funding of £326,560.

So what occurs subsequent?

In fact, previous efficiency is not any assure of future returns. The beautiful ascent of US shares may grind to a halt if the nation’s Large Tech giants run out of steam.

Low cost UK shares, however, may expertise a renaissance following years of underperformance.

None of us have a crystal ball. However interactive investor’s information reveals {that a} diversified portfolio throughout many areas can increase our possibilities of placing it wealthy.

Right here’s what I’m doing

I’ve lately determined to take a extra world outlook with my very own funding technique. I proceed to carry a big portfolio of UK shares, however I’ve additionally constructed positions in a number of exchange-traded funds (ETFs).

Certainly one of these is the Xtrackers MSCI World Momentum UCITS ETF (LSE:XDEM). This fund tracks the efficiency of shares which have loved spectacular value good points over the previous six to 12 months.

I really like this ETF as a result of it presents substantial publicity to high US shares. With round 66% of its capital invested in Wall Road heavyweights, together with tech titans Nvidia, Microsoft, and Amazon, it positions me nicely within the thriving US market.

Because the identify implies, this product additionally incorporates shares from different world indexes. Round 16% is invested in Japan, as an example, and an extra 7% in eurozone shares.

With a complete of 344 inventory holdings, this ETF gives me with strong safety via diversification throughout a number of international locations and sectors.

Its worldwide strategy leaves the fund weak to change charge fluctuations. Nonetheless, over the long run, I’m optimistic it should assist me retire comfortably. It might even assist me to make that million.