Picture supply: Getty Pictures.

You’ll usually learn that Shares and Shares ISAs are one of the simplest ways to construct money for retirement. That is because of the wonderful long-term returns that share investing tends to supply.

With a £500 month-to-month funding, right here’s how an investor might generate a wholesome passive earnings in retirement.

A £50k passive earnings

As I discussed, the returns loved by Shares and Shares ISA buyers might be appreciable. At 9.64%, the typical yearly return for the final 10 years trumps the 1.21% return that the Money ISAs offered. That’s in accordance with worth comparability web site Moneyfacts.

Accordingly, prioritising funding in certainly one of these riskier merchandise may very well be the simplest solution to construct sufficient wealth for a snug retirement. After all, Money ISAs can even play an important position in wealth creation by decreasing threat and offering a steady return throughout the financial cycle.

Let’s contemplate how somebody with £500 to take a position every month might make it work. How a lot they cut up between share investing and money will contain a fragile steadiness between their long-term objectives and their perspective to threat. On this case, let’s say they like a 75/25 cut up which may ship stable development whereas additionally offering a security web.

If they will match the averages of the final decade, they’d — after 30 years — have:

- £785,269 of their Shares and Shares ISA

- £54,220 of their Money ISA

This could give them a mixed retirement portfolio of £839,489 they may use for a passive earnings. With this cash, they may buy dividend shares, which ought to give them a gradual circulation of earnings. It will additionally give them an opportunity to proceed rising their portfolio.

In the event that they purchased shares yielding 6%, they’d have £50,369 to dwell on annually from their portfolio. Mixed with the State Pension, this might give them a bountiful complete retirement earnings.

A prime belief

Funding trusts just like the JPMorgan World Progress & Revenue (LSE:JGGI) product might be nice methods to construct wealth with a Shares and Shares ISA.

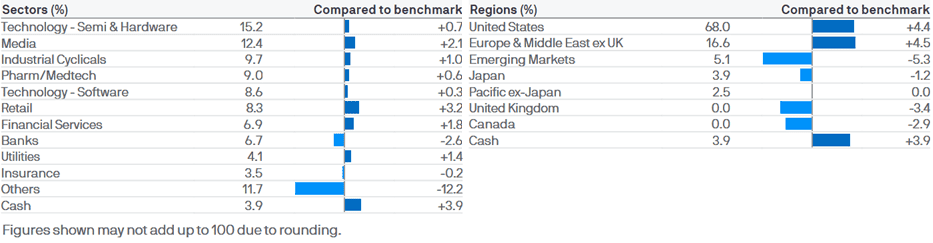

Thise diversified method offers a solution to goal capital features and passive earnings in a manner that successfully spreads threat. The JPMorgan car’s intention is to carry between 50 and 90 corporations at anyone time, throughout a spectrum of industries and areas:

By means of the usage of gearing (borrowed funds) — which right this moment stands at 1.85% of shareholders’ capital — the belief’s managers can even higher capitalise on investing alternatives as they come up.

Like different equity-based funding trusts, JPMorgan’s product can nonetheless fall throughout broader inventory market downturns regardless of its diversified method. Its use of gearing might also current greater threat. However I believe its long-term report speaks for itself.

Delivering a mean annualised return of 12.8% since 2015, it’s proved an effective way for UK buyers to construct wealth for retirement.