Picture supply: Getty Photos

I make investments nearly all of my spare money on the finish of every month in my Shares and Shares ISA. It’s a technique that, over time, might assist me turn into a kind of much-talked-about inventory market millionaires.

It’ll take time, self-discipline, and possibly even a bit little bit of luck. However with the correct technique, making a fortune with UK shares could be very potential — simply ask one of many 4,000+ traders who at present have a six-figure sum (or extra) sitting of their ISA as we speak.

The mathematical miracle often called compounding signifies that even these with a three-figure sum to speculate every month can ultimately get a seat on Millionaire’s Row. Let me present you the way this wealth-building trick works.

Compound positive aspects

Many UK shares pay out dividends to their traders as a proportion of those earnings. I can use these to assist me with my on a regular basis spending, or to splash out on a luxurious buy.

Alternatively, I can reinvest them to take my eventual returns to the subsequent degree. That is the strategy I’ve chosen.

I take advantage of the dividends I obtain to purchase extra shares in a selected firm or vary of firms. This reinvestment, over time, results in an increase within the variety of shares I personal, which then will increase the variety of dividends I obtain in a while.

Over a protracted interval — say a number of a long time — this ongoing cycle can create life-changing wealth. That is true even for individuals who solely have a number of hundred kilos a month to speculate.

Wealth constructing in motion

Let’s say I unfold £300 a month throughout FTSE 100 and FTSE 250 shares. If the mixed long-term common annual return of 9.3% stays unchanged I might, after 30 years, have £584,781 sitting in my ISA.

If I might bump my month-to-month funding as much as £520 I’d have made a good higher £1,013,621. I’d have turn into a kind of well-known ISA millionaires!

A high FTSE inventory

With my very own month-to-month funding I’ve constructed a strong, diversified portfolio dominated by FTSE 100 and FTSE 250 shares. This strategy helps me to scale back threat by not placing all my eggs in a single basket. It additionally permits me to capitalise on thrilling development alternatives.

Some shares even have extremely diversified enterprise fashions that provide the identical profit. Quick-moving shopper items large Unilever (LSE:ULVR) is one such inventory I personal; it has a number of ranges of diversification by:

- Product class: the Footsie agency owns greater than 400 manufacturers unfold throughout the non-public care, family items and meals segments.

- Geography: Unilever sells its merchandise into greater than 190 international locations throughout six continents.

- Model: the corporate typically has a number of product labels in a single class (similar to Partitions, Ben & Jerry’s, and Magnum in ice cream).

- Provide chain: the enterprise will get its uncooked supplies and different important merchandise from a large spectrum of worldwide suppliers.

Unilever is unlikely to ever report spectacular earnings development in anybody yr. What’s extra, earnings can decline now and again, for instance when shopper spending falls and/or enter prices rise.

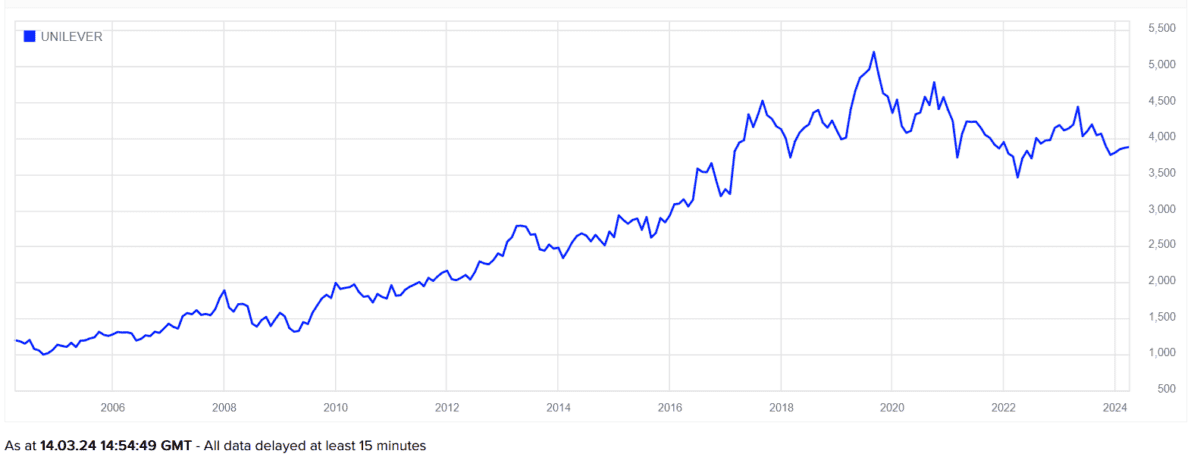

However helped by its diversified operations — to not point out its broad portfolio of heavyweight manufacturers — the corporate is ready to develop earnings nearly yearly. And over the long run, this has led to wholesome share value development (as proven above) and a steadily rising dividends.