Picture supply: Getty Photos

The variety of individuals utilizing an Particular person Financial savings Account (ISA) has jumped lately. I’m not shocked. These nice merchandise enable people to put money into a variety of property whereas saving them a boatload of cash on tax.

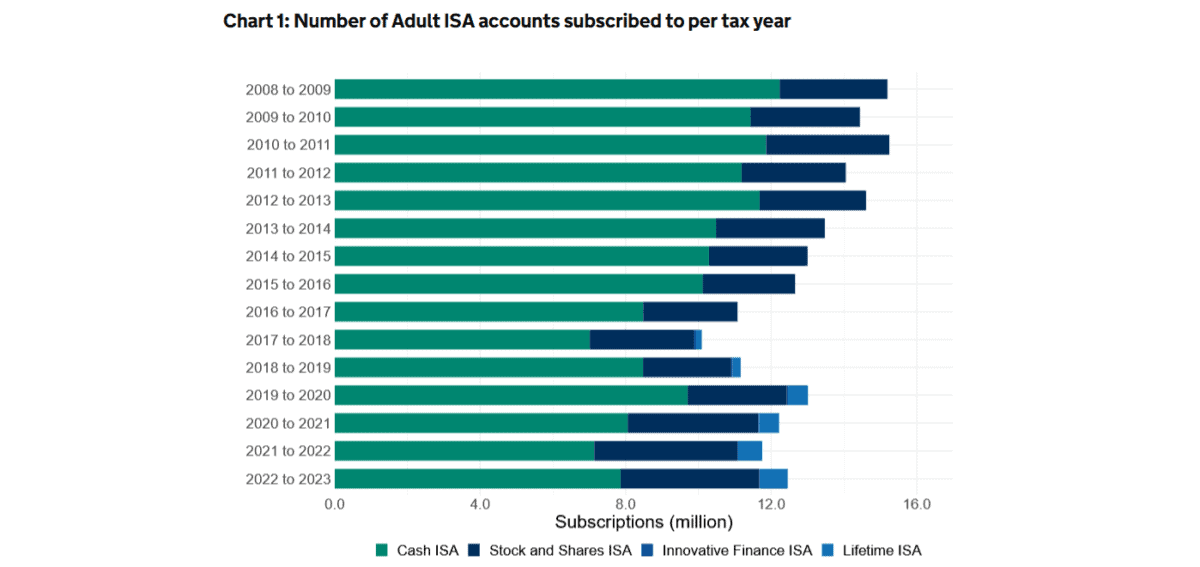

Within the 2022/23 interval, there have been 12.5m grownup subscribers to the ISA, in response to HM Income and Customs. This was up from 11.8m within the prior yr, and was pushed by a 722,000 rise in Money ISA subscriptions as individuals capitalised on robust financial savings charges.

I personal a number of forms of ISAs to focus on a life-changing passive earnings after I ultimately retire. Right here’s how they might assist me stay a lifetime of luxurious in my later years.

Please word that tax remedy is dependent upon the person circumstances of every consumer and could also be topic to alter in future. The content material on this article is offered for info functions solely. It isn’t meant to be, neither does it represent, any type of tax recommendation. Readers are answerable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

A £44,000 saving

Any capital features and dividends a person receives in an ISA are shielded from tax. And over time, this may add as much as a substantial amount of cash.

In a 2024 Monetary Instances article, asset supervisor Netwealth calculated that “a further price taxpayer investing £100,000 in a Shares and Shares ISA would save £44,000 in taxes over 10 years“. That is primarily based on a median yearly return of 5.9% and excludes buying and selling prices.

One downside with the ISA is that there’s a restrict on how a lot a person can make investments every tax yr. This places it an apparent drawback to a basic funding account (GIA). That’s in principle, at the least. In actuality, lower than one in 10 individuals really use their full £20,000 allowance every tax yr, me included.

I presently personal a Money ISA alongside a Shares and Shares ISA. I’m additionally one in all a smaller quantity of people that put money into a Lifetime ISA annually.

With the latter product, the federal government gives a 25% bonus on prime of any contributions I make. The utmost annual allowance right here is £4,000, and I can’t draw on my cash till I hit 60. However that tasty bonus is simply too good for me to disregard.

Focusing on one million

In a Shares and Shares ISA and Lifetime ISA, I can put money into a variety of monetary devices. This consists of exchange-traded funds (ETFs), one in all which I’m contemplating is the iShares Core S&P 500 UCITS ETF (LSE:CSPX).

As its identify implies, the fund invests within the 500 largest US-listed firms. This provides me as an investor publicity to severe high quality, in addition to glorious diversification throughout totally different sectors and areas of the world.

I additionally prefer it as a result of it has important capital tied up within the info expertise sector. Holdings like Nvidia, Apple and Microsoft may disappoint if the worldwide financial system stagnates or contracts. However they could additionally ship substantial returns because the digital revolution rolls on.

Since its inception in 2018, the ETF’s delivered a median annual return of 12.36%. If this continues, a £300 month-to-month funding may flip into £1,136,102 after 30 years.

This in flip, would give me a £45,444 passive earnings primarily based on a 4% yearly drawdown. Added to the State Pension, this might enable me to get pleasure from a really comfy life-style in retirement.

![10 Creative Infographics & Why They Work [With Examples]](https://makefinancialcenter.com/wp-content/uploads/2025/10/image-for-guest-article-SEJ_1600x840_-1-150x150.png)