Picture supply: Getty Photos

For many years, the FTSE 100 has confirmed to be a wonderful technique to earn a living. Since its inception in 1984, the UK’s main share index has delivered a surprising 7.48% common annual return. It’s a document that has enabled 1000’s of Shares and Shares ISA buyers to construct a wholesome nest egg for his or her retirement.

Previous efficiency isn’t all the time a dependable indicator of future returns. And investing my cash in shares is definitely riskier than parking it in a bog-standard financial savings account.

However specializing in Footsie shares can for the massive half be a secure technique to generate wealth. Most large-cap corporations have market main merchandise, robust model recognition, strong stability sheets and a number of income streams. These qualities can all make them strong long-term investments.

Constructing an enormous ISA

Let me present you ways I may earn a living with shopping for UK blue-chip shares. First, we’ll put down just a few floor guidelines to observe. We’ll say that:

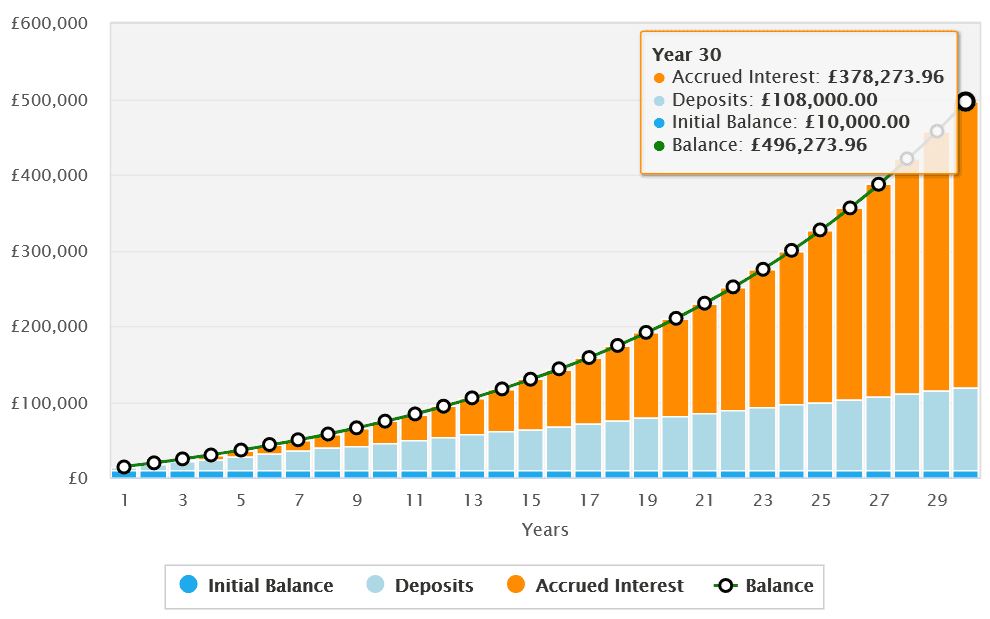

- I’ve £10,000 to spend money on my Shares and Shares ISA at first

- I put aside £300 every month to purchase Footsie shares

- I reinvest any dividends I’m paid to amass extra FTSE 100 shares

Now let’s assume that the FTSE 100 continues to offer that common annual return of seven.48%. If I stick with the plan outlined above, I might have an imposing £496,273.96 sitting in my ISA account after three a long time.

A high FTSE 100 share

I’d intention to hit that £496k goal with a mixture of riskier, cyclical shares and extra reliable development shares akin to Diageo (LSE:DGE). Firms like this have the mettle to extend earnings by means of good occasions and dangerous which, over the long run, can assist me steadily construct wealth.

There are a number of the explanation why Diageo is a dependable choose. The long-lasting branding and prime quality of merchandise like Captain Morgan rum and Guinness stout assure excessive demand in any respect phases of the financial cycle.

That is helped considerably by the drinks large’s monster promoting budgets which makes them important purchases. Final 12 months, it spent £1.4bn simply in North America to market its trendy labels.

Now Diageo isn’t completely proof against financial downturns. In the meanwhile it’s struggling as shoppers in Latin America and Caribbean really feel the pinch.

Nevertheless, the corporate’s extensive geographic wingspan nonetheless permits it to develop earnings nearly yearly, regardless of bother in a single or two areas.

A near-£20k passive revenue

So let’s say I’ve constructed that massive ISA nest egg of almost half one million kilos. How may I then translate that into an everyday passive revenue?

I’d achieve this by making use of the ‘4% drawdown’ rule. This might give me an everyday revenue for 30 years earlier than the properly ran dry.

At this fee I’d get pleasure from a wholesome £19,850.96 second revenue. When mixed with the State Pension, I’m assured this might give me a good lifestyle in retirement.

As I discussed earlier, investing in FTSE shares entails extra threat than easy saving. However the probability I’ve to make life-changing wealth nonetheless makes it your best option for me.