Picture supply: Getty Pictures

It’s by no means too late to attempt to construct a retirement fund by shopping for FTSE 100 and FTSE 250 shares.

Mixed, these London indices have supplied a mean annual return of 9.3% in current a long time. If this report continues, stuffing my portfolio with blue-chip shares may show to be an excellent plan.

Focusing on one million… with £520

The variety of Shares and Shares ISA millionaires has rocketed because the 2008 monetary disaster. However buyers don’t essentially want to speculate an unlimited lump sum to succeed in this enviable place. Nor have they got to ‘get fortunate’ by shopping for the following Apple, Amazon or some other world-changing development star earlier than it takes off.

Generally it simply takes a affected person method and an everyday month-to-month funding. Even these with zero financial savings or investments can get an area on Millionaire’s Row if they provide their portfolio time to develop.

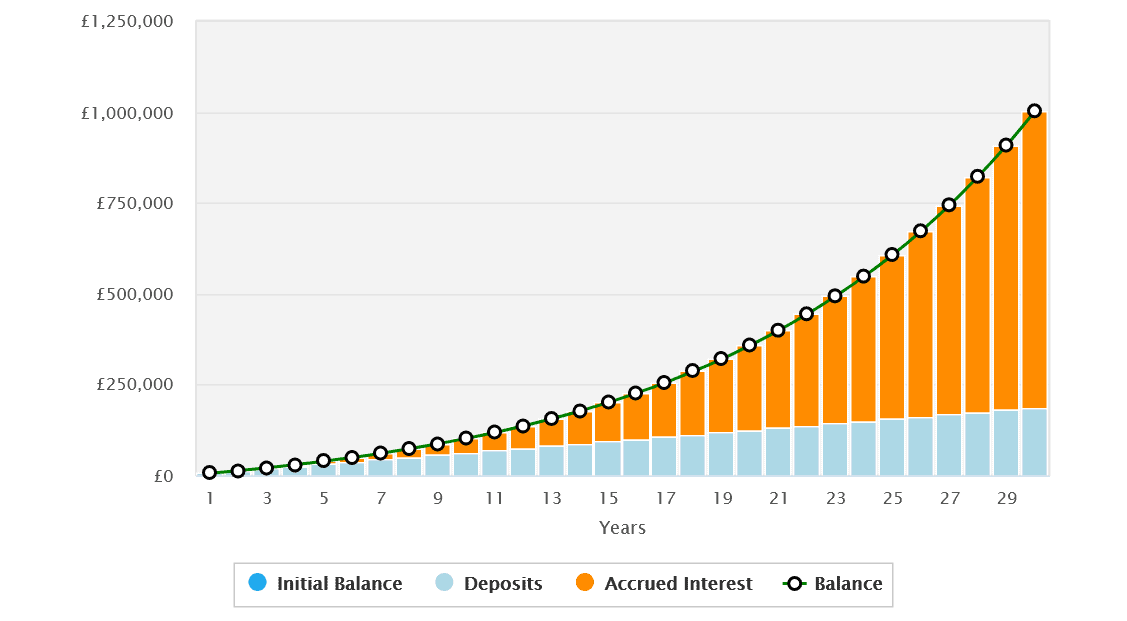

Let’s say I’ve nothing within the financial institution at present, however can make investments £520 a month in FTSE 100 and FTSE 250 shares. Because of the miracle of compound curiosity I may — after 30 years — have constructed a fund of one million kilos (or £1,013,620.51, to be precise).

Previous efficiency is not any assure of future returns. However that long-term return of 9.3% I discussed reveals what’s potential with a wise and constant investing technique.

An undervalued FTSE 100 star

I feel now is a wonderful time to begin investing in UK blue-chip shares too. After years of underperformance, the London Inventory Change is at the moment filled with undervalued stars.

Fears over Britain’s economic system and political panorama imply Footsie shares now commerce on a mean ahead price-to-earnings (P/E) ratio of 10.5 instances. That is far beneath the historic common of round 16 instances.

One dust low-cost share I’m contemplating shopping for at present is JD Sports activities Style (LSE:JD.). At 115p per share, it trades on a P/E ratio of simply 9 instances for 2024. That is properly beneath the corporate’s 10-year common of 16.9 instances.

This might probably result in the inventory delivering market-beating share value good points over the long run. I imagine its lowly valuation will get better over time as buying and selling situations rebound.

Why I’d purchase JD Sports activities shares

The sportswear enterprise has had problems with late as customers cut back on spending. The corporate slashed its full-year earnings steerage by 10% in January following current gross sales disappointment.

Whereas buying and selling troubles could stay a problem in 2024, the earnings outlook for JD Sports activities stays extraordinarily brilliant for the remainder of the last decade. And this makes the corporate a high purchase, for my part.

I particularly just like the FTSE agency’s determination to deal with the premium finish of the athleisure market. This section is tipped by market consultants to develop particularly quickly over the following 10 years, no less than.

JD’s sturdy relationships with essentially the most prestigious sports activities producers offers it added ammunition to use this chance. The exclusivity agreements it commonly seals on stacks of merchandise boosts its model, and makes it the go-to place for the most popular merchandise.

By persevering with to develop its world footprint, JD is placing itself within the field seat to capitalise on its rising market too. I’ll be trying to purchase this inventory after I subsequent have money to speculate.