Picture supply: Getty Photos

With the price of residing in retirement hovering, the significance of investing in UK shares is (for my part) rising significantly. New analysis from Shepherds Pleasant this week underlines the size of the problem going through us.

Utilizing the ’25 instances’ rule, it calculates that the common Briton will want £743,338 in financial savings, investments or different revenue to get pleasure from two-and-a-half a long time of economic independence. This idea suggests people should save 25 instances their annual wage to keep up their life-style for 25 years.

Shepherds Pleasant says its numbers are “primarily based on a mean annual expenditure of £31,653, amounting to £1,168,765 over 25 years with inflation, plus typical family debt of £121,525 and a six-month emergency fund.”

Constructing wealth

As one would count on, this £743,338 determine isn’t a one-size-fits-all goal. It suggests the lowest-earnings households will want £381,107 to maintain their monetary independence over 25 years.

Nevertheless, the quantity {that a} family within the high 10% of earners is 3 times that for decrease earners, Shepherds Pleasant says, at £1,322,483. That’s assuming a mean annual expenditure of £57,914.

A few of these figures appear monumental on paper. It underlines the significance of beginning early on the trail of retirement planning, the place the influence of compounding to construct wealth is best.

However whereas this may make an investing journey much less irritating and cheaper every month, it’s not not possible for these afterward to catch up. Right here’s one technique that would see a 40-year-old obtain monetary independence as soon as they hit the State Pension age of 68.

Investing properly

First, they need to contemplate opening a tax-efficient Shares and Shares ISA or Self-Invested Private Pension (SIPP). By defending themselves from capital positive factors and dividend tax, they’d get extra from their investments and provides them extra monetary firepower to compound their wealth.

Please word that tax remedy depends upon the person circumstances of every shopper and could also be topic to alter in future. The content material on this article is offered for data functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation. Readers are answerable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

The subsequent factor could possibly be to prioritise investing in UK and worldwide shares. Placing cash in financial savings accounts offers a assured return the place the cash is secure. Nevertheless, investing in low-yield money accounts is unlikely to generate the returns wanted for monetary independence.

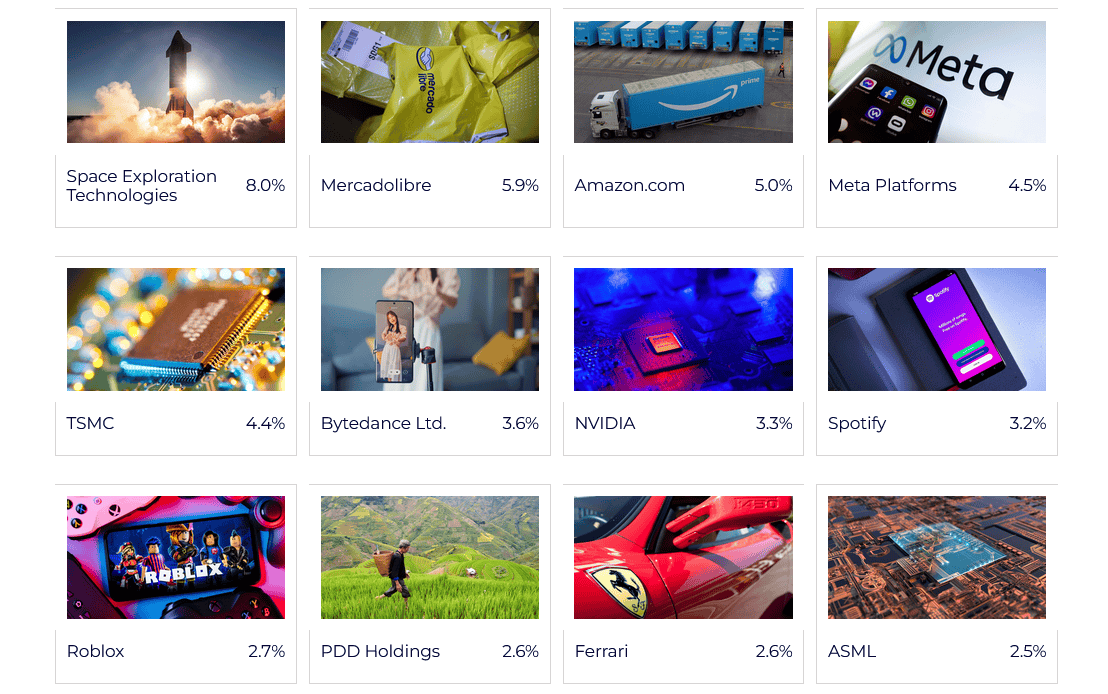

Traders can mitigate the higher-risk nature of inventory investing too, with out compromising the potential to make life-changing returns. This may be achieved with an funding belief that holds a portfolio of belongings, like Scottish Mortgage Funding Belief (LSE:SMT).

It’s title is deceptive, as fairly than investing in loans or actual property, it truly focuses on high-growth know-how shares. This could depart it susceptible to underperformance throughout downturns. However over the long run, it offers the facility for buyers to harness white-hot tech developments like synthetic intelligence (AI), house exploration, robotics and cloud computing.

Certainly, since 2015 it’s delivered a mean annual return of 15.9%. As a part of a wider portfolio, I feel it could possibly be a good way to construct wealth over time.

A 40-year previous, investing £500 in UK shares and attaining a 9% yearly return, may obtain that magic £743,338 retirement fund by the point they hit State Pension age. Nevertheless, it’s necessary to keep in mind that returns may fall wanting that focus on in addition to exceed it.

![10 Creative Infographics & Why They Work [With Examples]](https://makefinancialcenter.com/wp-content/uploads/2025/10/image-for-guest-article-SEJ_1600x840_-1-150x150.png)