Picture supply: Getty Photographs

I’m constructing a portfolio of formidable FTSE 100 shares in my Shares and Shares ISA. Right here’s one I feel might assist me ultimately retire in consolation.

Investing in FTSE 100 shares has confirmed a profitable funding technique for an excellent many traders. Since its inception within the mid-Nineteen Eighties, the UK’s main share index has delivered a mean annual return of seven.5%.

This is much better than the return money accounts have supplied over that interval. And it reveals that traders don’t have to put money into high-risk securities like cryptocurrencies to construct wealth both. It’s why I’ve invested closely in UK blue-chip corporations.

Nevertheless, I’m not limiting my purchasing checklist to Footsie shares. My portfolio can be filled with FTSE 250 shares that might present a tasty mix of capital positive factors and passive revenue.

It’s a plan that might take my wealth to the following stage if historical past repeats itself. The FTSE 250 has delivered a good higher common yearly return of 11% for the reason that early Nineties.

A BIG passive revenue

After all previous efficiency isn’t any assure of future returns. However let me present you the kind of cash I might make if these two UK share indices retain their spectacular information.

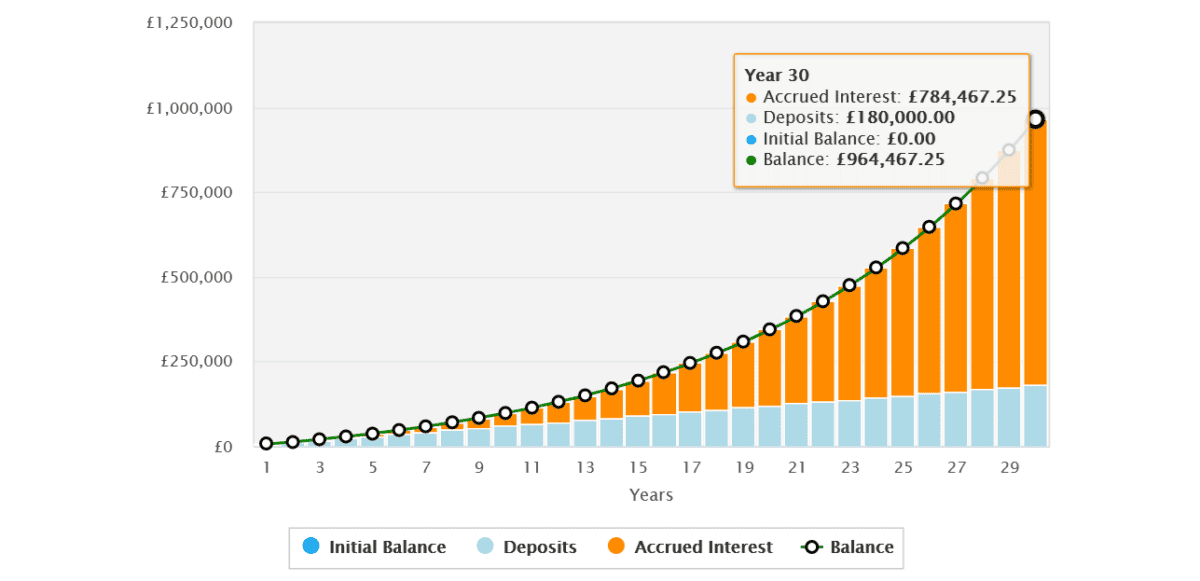

We’ll say that I purpose to speculate equally throughout FTSE 100 and FTSE 250 shares. We’ll additionally assume I’ve £500 to speculate every month, I reinvest any dividends I obtain, and I don’t contact my hard-earned positive factors for 30 years.

Based mostly on this standards, I might make a life-changing £964,467. And if I then resolve to take 4% of this quantity a 12 months as passive revenue, I’d have a juicy £38,579 to retire on.

A high FTSE 100 inventory

A method I might hit these figures could be by shopping for one or two tracker funds. The iShares 350 UK Fairness Index Fund for example tracks the efficiency of each FTSE 100 and FTSE 250 shares.

Alternatively, I might attempt to obtain market-beating returns by shopping for particular person shares. This can be a path I’ve most popular to go down. And I’ve loaded my Shares and Shares ISA with steady progress and dividend shares together with riskier shares to hit this aim.

BAE Techniques (LSE:BA.) is one ultra-robust Footsie agency I’d purchase at the moment. Its shares have rocketed since 2022 following the beginning of the conflict in Ukraine. I’m tipping them to proceed rising too, as nations embark on a protracted rearmament course of.

International locations throughout North America and Europe are mountain climbing arms spending in response to the rising budgets of China and Russia. It’s a cycle that’s prone to drag on — Beijing introduced plans to boost defence expenditure by 7.2% this 12 months — and within the course of drive enterprise at main Western defence contractors like BAE Techniques.

Orders right here jumped to a report of £37.7bn in 2023 towards this supportive backdrop. And this in flip pushed its order backlog to an all-time excessive of £69.8bn.

Though mission execution issues are a continuing danger that might dent earnings, I nonetheless suppose the potential advantages of proudly owning BAE Techniques shares outweigh these risks. It’s why I’ll be wanting so as to add the corporate to my ISA after I subsequent have money to speculate.