Picture supply: Getty Pictures

How massive would a Shares and Shares ISA must be to generate a £3,000 second revenue every month? If invested in 6%-yielding property (like dividend shares, bonds and funding trusts), the determine comes out at £600,000.

The calculation’s easy: a second revenue of £3,000 a month works out at £36,000 a 12 months which, when divided by a 6% yield, provides a determine of £600,000. Due to the ISA’s tax advantages, an investor doesn’t need to pay a single penny from their portfolio to the taxman.

That £600k might appear like a considerable sum of cash. And to be honest, it’s. However thanks to 2 key forces — the facility of compound returns, and the large progress potential of the worldwide inventory market — hitting this magic quantity is greater than achievable over time.

Please notice that tax remedy is dependent upon the person circumstances of every consumer and could also be topic to vary in future. The content material on this article is supplied for data functions solely. It isn’t supposed to be, neither does it represent, any type of tax recommendation. Readers are chargeable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

Constructing a £600k ISA

In keeping with Shepherds Pleasant, the typical Briton invests £514 a month. At this degree, somebody who makes use of this to spend money on an ISA over a few a long time may realistically goal a £3k second revenue.

Let’s say we have now an investor who achieves a formidable common annual return of 11.2%. That charge of return matches the efficiency of the MSCI World Index — which tracks the efficiency of 1,325 international shares — over the previous decade.

Excluding buying and selling charges, stamp responsibility and different prices, our investor would have turned a £514 month-to-month funding into £602,842 in simply over 22 years. That may comprise whole deposits of £137,238, and greater than £465,604 in compound returns, with dividends reinvested.

Belief train

Investing within the inventory market will be unpredictable. However over the long run, it’s persistently (and infrequently handsomely) rewarded affected person traders.

Buyers may easy out short-term volatility and handle danger by buying funding trusts and/or exchange-traded funds (ETFs). These diversified devices can maintain a variety of property, permitting a easy return throughout the financial cycle.

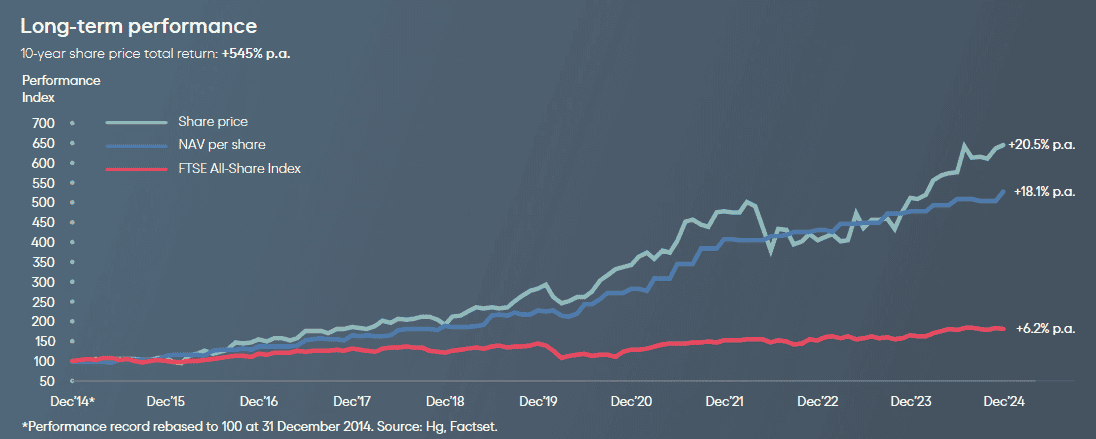

Take the HgCapital Belief (LSE:HGT) for instance. Delivering a mean annual return of 20.5% between 2014 and final 12 months, this product might be a fantastic belief for our investor focusing on that £3k passive revenue to contemplate. However bear in mind, previous efficiency isn’t at all times a dependable information to future returns.

With internet property of £2.4bn, the belief’s targeted on fast-growing software program and companies companies that aren’t listed on inventory exchanges. These embody the likes of Visma, whose software program is used for capabilities like payroll, procurement and accounting, and Howden, which is the most important insurance coverage middleman outdoors of the US.

In whole, HgCapital has holdings in additional than 50 firms. Although it’s nonetheless weak to financial downturns, its diversification by finish market and geography helps unfold danger and ship spectacular outcomes. On a trailing 12-month foundation, its portfolio has delivered gross sales and EBITDA progress of 20% and 21% respectively.

Constructing a passive revenue of £3k a month with an ISA isn’t easy. However with correct analysis, common investing and endurance, it’s completely achievable.