Picture supply: Getty Photographs.

People can attempt to construct a wholesome second revenue for retirement in quite a few methods. Merchandise just like the Money ISA have loved a renaissance extra lately as financial savings charges have perked up.

Based on HM Income and Customs, the variety of Money ISAs that had been subscribed to in 2022/23 rose by a whopping 722,000 12 months on 12 months, to simply underneath 7.9m. It’s no coincidence that this coincided with the Financial institution of England beginning its rate of interest mountaineering cycle in late 2021.

Nevertheless, opting to simply save money slightly than make investments may lead to important missed returns, and the state of affairs might solely worsen over time.

Let me present you ways.

Charges to drop?

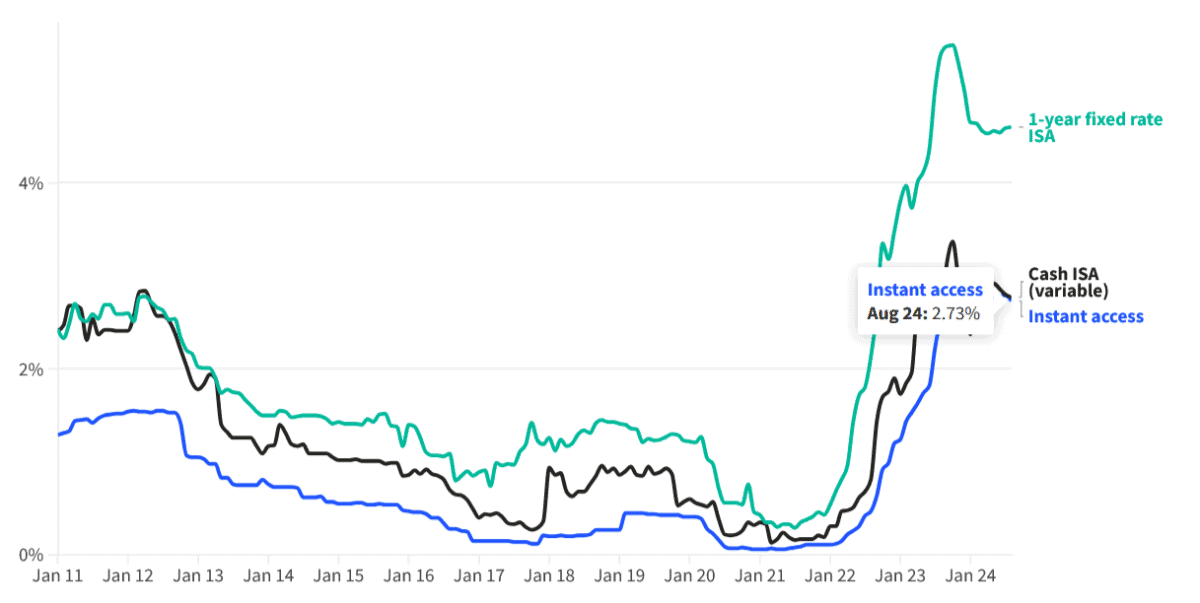

At this time, top-of-the-line easy-access Money ISA in the marketplace gives a wholesome 5.12% rate of interest. Because the chart beneath exhibits, the typical fee for these tax-friendly merchandise is comfortably forward of what savers loved between 2011 and 2022.

Nevertheless, charges are tipped to fall steadily throughout the market because the BoE begins to loosen financial coverage. So leaving all one’s cash locked in a financial savings account could possibly be an enormous mistake.

For the sake of this instance, let’s say that the best-paying Money ISA gives a fee of 4% for the following 30 years. A £300 funding every month at this fee would make me £208,215 over the interval.

If I then drew down 4% of this annually, I’d have a month-to-month revenue of £694.

Higher returns

That’s far beneath what I could possibly be making if I invested in, say, the FTSE 100 or FTSE 250 as an alternative. These UK share indexes have offered a mean long-term return of seven% and 11% respectively over the long run.

Nevertheless, it’s important to keep in mind that previous efficiency isn’t a dependable information to future returns. Share investing is way riskier than parking my cash in a safe financial savings account, and I may even make a loss on sure shares. This is the reason having a specific amount in financial savings for emergencies is all the time a good suggestion.

Decreasing threat

That is additionally why investing in an exchange-traded fund (ETF) could possibly be a good suggestion. These monetary devices unfold threat by allocating my money throughout a variety of equities.

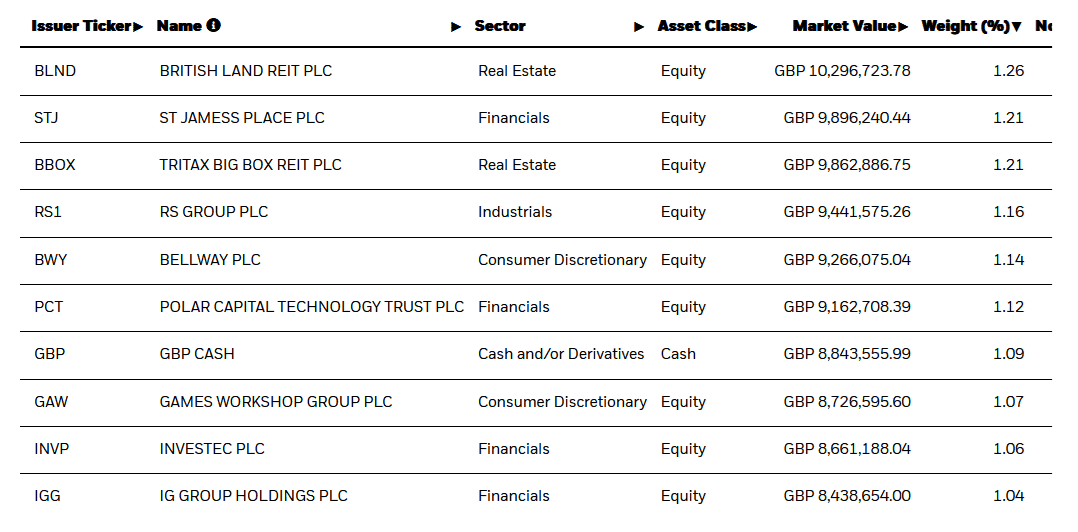

Based mostly on the above, shopping for the iShares FTSE 250 UCITS ETF (LSE:MIDD) could possibly be an important thought. By investing my money throughout a whole lot of various firms, I’ve publicity to a mess of industries and geographies, thereby minimising the influence of underperformance in anybody specific space.

Moreover, the ETF offers me with a mixture of cyclical and defensive shares, which might present me with a clean return over time. There’s the chance, nevertheless, that the fund’s deal with UK shares could possibly be an issue ought to broader demand for British belongings decline.

If the FTSE 250’s long-term return of 11% continues, a £300 month-to-month funding on this ETF would flip into £841,356 after 30 years, excluding the influence of slight monitoring errors.

That might then make me a month-to-month £2,805 passive revenue primarily based on a 4% drawdown fee. That’s 4 instances greater than the £694 I’d take pleasure in by put money into that 4%-yielding Money ISA talked about above.

It’s why I plan to proceed investing in shares and funds over merely saving money.