Picture supply: Getty Pictures

To my thoughts, one of the best ways to try to create a passive revenue is to put money into a broad vary of UK shares.

Purchase-to-let? Rents are rising properly, however excessive startup prices and day-to-day administration are fairly off-putting for me. Establishing a side-hustle takes an excessive amount of effort and time.

What about financial savings accounts? Properly, with rates of interest falling once more, I’m anticipating these merchandise to start out delivering mediocre returns once more.

Previous efficiency isn’t any assure of future returns. However with the Shares and Shares ISA delivering a median annual return of 9.64% (based on Moneyfarm analysis) up to now decade, I feel constructing a portfolio of British shares will probably be one of the best ways to go.

However how a lot would I would like to speculate so I can cease work and stay off the passive revenue?

Hitting a £50k revenue

The very first thing I would like to think about is how a lot my on a regular basis bills will probably be. I additionally should take into consideration what luxuries I wish to take pleasure in. In spite of everything, none of us wish to work for many years with out having some lavish dwelling to stay up for.

It may be fairly laborious to foretell these figures, and particularly accounting for potential inflation. Nevertheless, I can get a tough concept of what I’d want utilizing analysis from the Pensions and Lifetime Financial savings Affiliation (PLSA).

It says the typical single individual wants £43,100 a yr to stay a cushty retirement. Individuals on this bracket will get to take pleasure in common holidays within the UK and abroad, a brand new automotive each few years, and a four-figure kitty to spend on garments.

For this train, I’ll spherical my annual revenue goal as much as £50,000 to provide me a margin of security. So how a lot will I would like to speculate annually to achieve this?

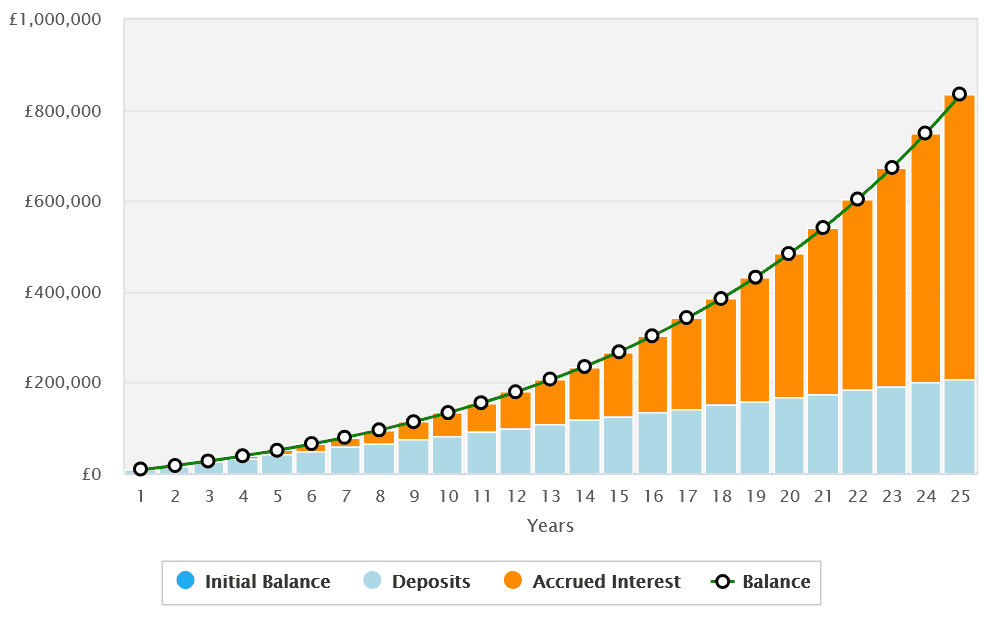

If I can handle to hit that 9.64% common return that ISA traders take pleasure in, I’ll have to spend £8,376 a yr on UK shares for 25 years, reinvesting any dividends I obtain alongside the way in which.

At this level, I’ll have constructed a nestegg north of £833,420.

I may then make investments this in 6%-yielding dividend shares to focus on simply over £50,000 in passive revenue annually. Bear in mind, nevertheless, that dividends are by no means assured.

A high FTSE 100 purchase

To construct this huge retirement fund, I’d look to purchase a mix of progress and revenue shares. I’d additionally search out undervalued shares which, over the long run, may ship higher capital appreciation than the broader market would possibly.

FTSE 100 mining big Rio Tinto’s (LSE:RIO) one such share I’ve already purchased for my portfolio. With a ahead price-to-earnings (P/E) ratio of simply 8.5 instances, I feel it seems fairly low-cost at present costs.

With an enormous 6.9% dividend yield for this yr alone, it may additionally present me with an honest dividend revenue which I can reinvest to develop my portfolio.

The returns I get from my Rio shares may disappoint throughout financial downturns when earnings come below strain. However over time, I consider the corporate will ship giant capital good points and dividends as demand for pure assets like copper and iron ore heats up.