Picture supply: Getty Pictures

Having a second retirement earnings along with a pension is the dream of many. However somewhat than ready to win the lottery, I imagine a strategic UK share portfolio may very well be one solution to obtain this. And in contrast to shopping for property, inventory investing doesn’t require lots of money to get began.

Plus, historical past reveals proof of equities’ spectacular long-term returns, usually exceeding different choices.

Think about turning a mere £5,000 funding right into a self-sustaining earnings stream of over £1,000 each month. Sounds fantastical, proper? Nicely, buckle up, as a result of I’m about to unveil my plan to attempt to make this dream a actuality!

Choose an funding account

I believe the most suitable choice for UK residents is to open a Shares and Shares ISA. With this product, customers can spend money on a variety of property as much as £20,000 a yr with no tax obligations on the capital beneficial properties. It’s in all probability the most effective methods to get probably the most out of a portfolio of shares.

Different buyers solely targeted on retirement could want a Self-Invested Private Pension (SIPP), permitting as much as £60,000 a yr. However keep in mind, this cash is locked up till retirement.

Each choices are an effective way to speculate tax-free in shares and shares to construct a second earnings.

Please observe that tax therapy will depend on the person circumstances of every consumer and could also be topic to alter in future. The content material on this article is offered for data functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation. Readers are answerable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding selections.

Selecting the best-performing shares

I don’t know anyone with a crystal ball that may predict the most effective shares to purchase. No person really is aware of for certain precisely which shares will outperform others. However there are methods to make better-informed decisions.

There’s a standard disclaimer utilized in finance: “Previous efficiency is not any indication of future outcomes.” That could be true. However I nonetheless discover that established corporations with a superb historical past have a greater likelihood of performing effectively.

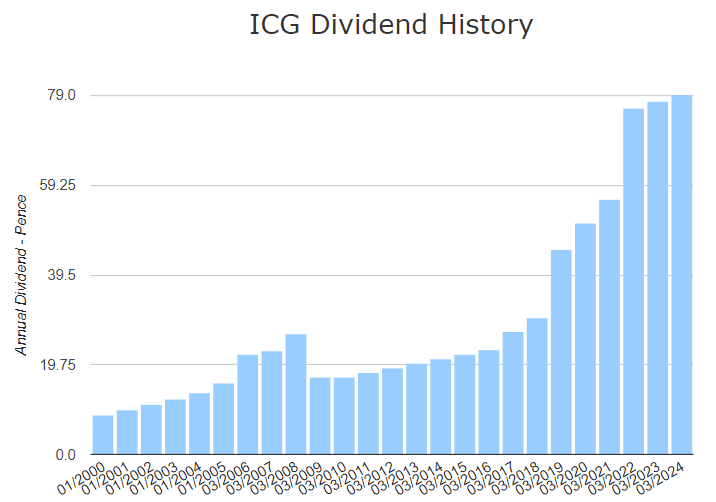

That’s why I take a look at an organization’s cost historical past when contemplating shares for dividends. Take the UK-based personal fairness funding agency Intermediate Capital Group (LSE: ICG) for instance.

Apart from a quick discount in 2009, this FTSE 100 constituent has been paying a persistently growing dividend for twenty-four years. From 8.65p per share in 2000, the dividend has elevated to 79p per share this yr. In simply the previous 10 years, it’s grown at a compound annual progress charge (CAGR) of 14.17%.

And it’s not simply dividends. In the identical interval, the share worth has elevated by 787.4%, representing an annualised return of 9.52% per yr.

So £5,000 invested right into a inventory with these returns may develop to £145,635 in 22 years. Assuming the dividends proceed to develop as they’ve been, that quantity would pay out £12,898 in annual dividends — over £1,000 a month.

However personal fairness could be dangerous.

It’s closely reliant on world markets performing effectively. A monetary crash or recession may harm the share worth and dividend funds, which occurred in 2008 and 2020. If rates of interest stay excessive it may drive up borrowing prices and dampen market sentiment.

The share worth has additionally shot up in recent times, suggesting it might be overvalued and will expertise a reversal quickly. The corporate is valued at £6.4bn however doesn’t have lots of money to cowl its £1.49bn debt.

Nonetheless, I believe it’s a superb instance of a long-term, dependable dividend payer. As such, I believe it’s price contemplating as a part of a portfolio of earnings shares aimed toward constructing wealth for retirement.