Picture supply: Getty Pictures

All of us dream of creating a wholesome second earnings with minimal effort. My chosen technique of producing a passive earnings is by making a diversified portfolio of UK shares in a Shares and Shares ISA.

Like billionaire investor Warren Buffett, I like to focus on undervalued shares which have the potential to ship beautiful share worth features because the market wises as much as their funding potential.

I additionally like to seek out shares that pay excessive dividends. By reinvesting the payouts they supply, I can purchase extra shares, which give me extra dividends, which provides me extra money to purchase extra shares… and so forth.

Compound advantages

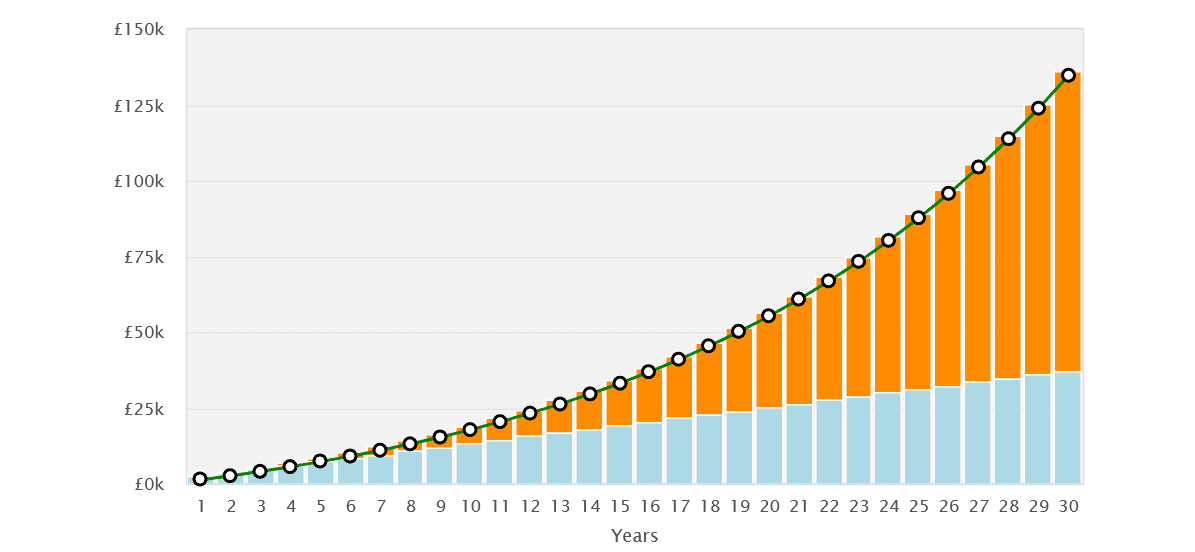

This course of is known as compounding. And it has the potential to turbocharge my wealth over time. Over 30 years, even a modest £100 month-to-month funding in FTSE 100 shares may create a retirement fund of £134,744.54.

That’s based mostly on the Footsie’s common annual return of seven.5% between 1984 and 2022. The helpful impression of compounding to my wealth might be seen within the chart beneath.

That stated, I believe I may make higher returns by deciding on particular person shares reasonably than investing in a FTSE 100 tracker fund.

A high FTSE 100 inventory

One in all my favorite shares I’ve not too long ago acquired for my very own ISA is Aviva (LSE:AV.). It fills two key standards for me, particularly its shares look undervalued, and it has a terrific observe file of paying market-beating dividends.

For 2024, the life insurance coverage big trades on a price-to-earnings (P/E) ratio of 9.6 occasions. In the meantime, its dividend yield for this 12 months sits at a huge 8%.

Monetary providers corporations like this might battle if shopper spending stays weak. However I imagine this menace is greater than baked into Aviva’s rock-bottom share worth.

I believe the enterprise has distinctive long-term funding potential as residents in its UK, Eire and Canadian markets quickly age. On this local weather, demand for its safety and retirement merchandise may soar.

I additionally like Aviva shares due to the corporate’s robust money era and deep capital reserves. This might give it additional power to maintain paying giant dividends. Its Solvency II capital ratio additionally stood at a powerful 200% as of September.

A £531 month-to-month earnings

£10,000 invested in Aviva inventory in the present day would give me a second earnings of £800 this 12 months, offering dealer forecasts show appropriate. If the dividend yield stayed the identical at 8% for 10 years — and I took my dividends out to spend — I might make £8,000.

Nonetheless, if I made a decision to reinvest my dividends I might have made a far increased £21,589. If the dividend yield stayed the identical for 30 years, I might have generated a huge £100,627, comprising that £10,000 preliminary funding and £90,627 value of dividends.

Now let’s say I can afford to double up and make investments £800 additional a 12 months in Aviva shares. I might have made a strong £191,253, a sum that would actually supercharge my passive earnings. It might — over three many years — give me a month-to-month second earnings of £531.

The potential for share worth and dividend development means I may make a fair bigger nest egg over time too, and due to this fact a extra spectacular passive earnings. However even excluding these two phenomena, I may nonetheless probably make an excellent additional earnings for my retirement.