I’ve partnered with WizeFi on this WizeFi Evaluation. All opinions are 100% my very own. I’m excited to let you know a few new cash instrument that I not too long ago began utilizing. Are you searching for a cash administration instrument that may allow you to price range, save lots of of {dollars} every month, and speed up your path to…

I’ve partnered with WizeFi on this WizeFi Evaluation. All opinions are 100% my very own.

I’m excited to let you know a few new cash instrument that I not too long ago began utilizing.

Are you searching for a cash administration instrument that may allow you to price range, save lots of of {dollars} every month, and speed up your path to monetary independence?

In that case, then I like to recommend trying out WizeFi. This cash administration software program can be utilized out of your cellphone or laptop, and provides you with all of the instruments that you want to take management of your funds.

Understanding cash might be difficult, particularly if you’re working in direction of long-term monetary freedom. WizeFi helps you optimize your cash to scale back waste and put your cash the place it’s best at accelerating monetary freedom. It’s made for people who find themselves critical about monetary freedom.

Please click on right here to check out WizeFi without spending a dime for 30 days.

WizeFi proper now could be internet hosting a free 30-Day Monetary Independence Problem to be able to have a transparent plan for reaching monetary independence and retirement. You may join WizeFi and the free 30-Day FI Problem by clicking right here.

WizeFi Evaluation

Beneath is my WizeFi overview. I shall be speaking about why it was began, the other ways this instrument will help you, the associated fee, and reply some frequent questions.

What’s WizeFi?

WizeFi is a useful cash instrument in your laptop or cellphone that helps you attain monetary freedom. It’s like having your personal cash coach, serving to you to make higher choices along with your funds.

Right here’s what WizeFi does:

- WizeFi helps you handle and eradicate debt, rapidly! WizeFi will kind your debt in an environment friendly pay-off order to avoid wasting you cash and repay your debt rapidly. Plus, the 30-day problem provides you with tricks to speed up your debt freedom journey.

- WizeFi tells you your monetary independence date. Be taught the place you’re headed now in case you change nothing along with your funds, after which be taught what you are able to do to succeed in retirement sooner.

- WizeFi finds hidden spending habits that could be getting in the way in which of your monetary targets. For instance, it can allow you to discover out about on a regular basis habits that you simply didn’t know may postpone your retirement by 5 years.

- WizeFi makes plans only for you, not utilizing generic templates that match everybody.

- WizeFi helps you make good selections by offering the power to create “what if” situations, which it calls “drafts” to check monetary selections earlier than you really make them. This will help keep away from pricey errors like main purchases that would delay your monetary freedom date by years. Or, uncover alternatives for making use of bonus cash (like tax returns) the place they will have the largest impression in your monetary targets.

- WizeFi retains an eye fixed in your progress and motivates you by displaying seen outcomes. For instance, understanding how little adjustments can change your future internet price.

- WizeFi makes cash much less complicated and boosts confidence, lowering the stress about funds.

- WizeFi helps you be taught cash abilities, making you much less reliant on others and extra assured in managing your personal funds.

As quickly as you begin utilizing WizeFi, you’ll discover it’s not nearly monitoring bills. The software program is constructed across the idea of empowering you to develop cash habits that would probably halve the time it takes to succeed in your monetary targets, resembling early retirement or monetary independence.

I’ve signed up for WizeFi, and I actually like how simple the platform is to make use of. There aren’t any adverts they usually aren’t attempting to promote anything that’s further, so that you don’t have anything cluttering this instrument if you find yourself attempting to make use of it. It’s straight to the purpose.

Why WizeFi was began

WizeFi was began in 2017 by Sean Allen, a monetary professional and 30-year veteran of the monetary trade. He was noticing that shoppers had been failing with their funds, despite the fact that they had been making sufficient cash for early retirement.

He discovered that there have been two essential causes of this:

- An absence of cash abilities and

- Not understanding the long run impression of present selections (resembling spending).

He then realized that there was a necessity for a change in the way in which that individuals strategy cash administration in order that they will repay their debt and attain monetary independence.

To discover a resolution to those challenges, he created WizeFi, beginning as a program and later changing into an app. It focuses on benefiting from each greenback you earn. WizeFi is all about serving to you handle and eradicate money owed and bills that don’t profit you financially.

The app goals to succeed in hundreds of thousands with its simple (but efficient) strategy, rushing up the trail to monetary independence and giving folks the power to create an enduring system for constructing wealth.

How WizeFi Is Useful

Should you’re discovering it laborious to determine why your cash targets really feel distant, WizeFi is the instrument that may present you the patterns and selections that could be inflicting the problem. As a substitute of being confused by a bunch of numbers, you’ll be capable of see precisely the place your cash goes every month.

WizeFi helps you create a price range that matches your private monetary state of affairs, and your monetary plan is personalized to you, making it extra probably that you simply’ll follow it and see actual outcomes.

Listed below are some ways in which WizeFi will help you:

- Uncover your monetary independence date. Be taught the place you’re headed now in case you change nothing along with your funds, after which be taught what you are able to do to speed up your FI date.

- Discover leaks in your spending habits: WizeFi will present you your spending all month lengthy and examine it to your deliberate spending. This may be very eye-opening and allow you to uncover spending habits you may change

- Develop wealth-building habits: Talking of habits, WizeFi is all about serving to you develop cash abilities that result in wholesome monetary habits. For instance, if you subscribe, WizeFi begins you off with a 30-day problem that may assist substitute dangerous habits with good habits. Strive it for your self.

WizeFi helps with three essential cash abilities: Cash Organizing, Cash Planning, and Cash Monitoring.

Cash Organizing

WizeFi will sync along with your monetary accounts and arrange your cash into classes, after which it can present a tenet spending quantity for every class. See how your spending compares to the rule.

Cash Planning

WizeFi goes past simply organizing your cash; it additionally offers you a tenet to be able to know methods to finest use your cash. It makes a personalised plan that matches your particular targets and monetary state of affairs, encouraging a proactive strategy to your monetary future.

WizeFi features a course of the place you may undergo every space of your funds and you’ll see how chopping again on sure bills can improve cash for use in direction of accelerating your monetary independence.

So, I may see how chopping again on eating out would give me extra “monetary independence {dollars} (FID) which WizeFi will then present me the very best place to place these {dollars} within the 4-step plan. I can use WizeFi to plan the proper price range that frees up FI-dollars.

Then, I can use WizeFi to find out the very best use of these {dollars}—repay debt, add to 401(okay), or repay a mortgage early – no extra guessing. WizeFi will reveal which selections speed up monetary freedom and which delay it.

Cash Monitoring

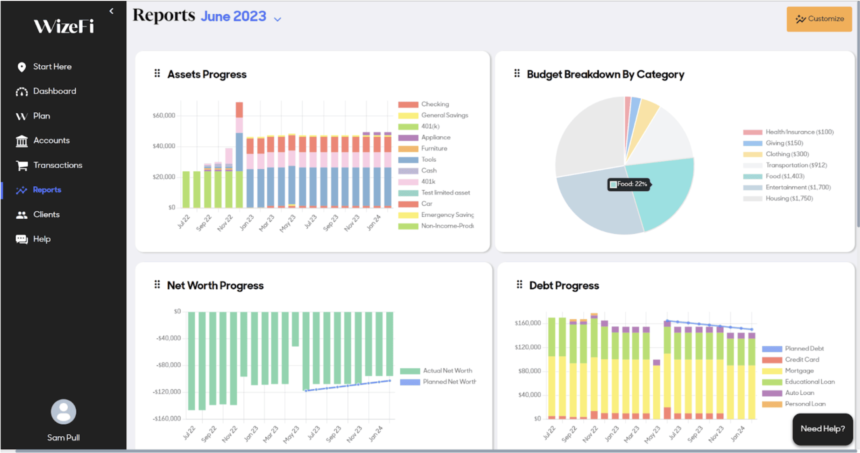

WizeFi lets you monitor your cash, resembling your price range, spending, earnings, debt payoff progress, and internet price. Figuring out these numbers and with the ability to monitor them will help inspire you to make adjustments for the higher.

Cash monitoring is thought to assist folks suppose in a different way about their cash. It retains folks always conscious of the place their cash goes in comparison with the place it needs to be going.

WizeFi offers month-to-month reporting to watch your monetary tendencies like is your internet price rising and your debt shrinking, and is your price range balanced such as you need it to be.

WizeFi additionally offers real-time monitoring with progress meters so you may watch your cash day by day to be sure to keep on observe. Each of those are key to empowering you to be an amazing supervisor of your cash with out having to turn out to be a monetary analyst. WizeFI retains it easy.

How To Get Began With WizeFi

WizeFi lets you higher handle your funds from each a pc/laptop computer and out of your cellphone. In addition they have a 30-day e-mail problem that teaches you the way to economize, make cash, and develop cash abilities.

As you take a look at what WizeFi can do, you’ll see it offers numerous instruments to enhance the way you deal with cash. With easy-to-use options and a transparent plan, WizeFi is designed to information you towards monetary freedom in a greater and more practical means.

Right here’s how one can get began:

- Join the 30-day free trial of WizeFi and get enrolled within the 30-day problem

- Enter your targets, resembling your emergency fund goal, normal financial savings goal, and your required month-to-month earnings at retirement.

- Enter your wage (internet month-to-month earnings after taxes), any aspect hustle earnings, investing earnings, and extra.

- Enter and join your monetary accounts, resembling financial institution, automobile mortgage, mortgage, retirement accounts, and extra.

- After you enter the knowledge above, you will note your monetary freedom projections. This can present you the precise date that WizeFi thinks it is possible for you to to retire in case you proceed the way in which that you’re along with your monetary state of affairs. Additionally, you will see WizeFi’s built-in wealth potential guideline and the precise date you’ll be debt-free.

WizeFi 30-Day Monetary Independence Problem

As you observed above, I feel the easiest way to get began with WizeFi is to enroll and take their 30-Day Monetary Independence Problem.

WizeFi simply launched this problem and it’s a free, day by day information crammed with steps that will help you develop your cash smarts and dash towards monetary independence quicker than you would possibly suppose doable. You’ll obtain an e-mail day by day with new actions to take that may refine your spending and saving habits.

Listed below are a number of highlights of the problem:

- Scale back bills – You’ll see how small adjustments in day by day spending can create massive financial savings over time. You’ll really be taught 200 totally different methods to cease losing cash!

- Debt mastery – Get tips about dealing with money owed that stand in your means.

- Construct wealth – Study methods that may improve your earnings.

On Day 1, you begin crafting your very personal FI plan. This units the inspiration. By Day 2, you’re diving into methods to spend much less on meals, and by Day 3, it’s all about saving on transportation. All through the problem, you’ll be taught to chop prices throughout many various spending classes with out sacrificing the enjoyable in your life.

Day 9 exhibits you highly effective wealth-building methods. As you strategy Day 17, you’ll see the 5 phases of economic independence.

Leaping into Day 20, get artistic with 50 aspect hustle concepts to spice up your earnings. In a while, Day 26 focuses on investing techniques designed to hurry you alongside to FI.

It is a free problem that’s despatched straight to your e-mail. I’m signed up for this problem and it is filled with actionable ideas which can be really useful (and never simply fluff or generic ideas).

You may join the free 30-Day FI Problem by clicking right here.

WizeFi Price

So, after studying all the above, you’re in all probability questioning “How a lot does WizeFi price?”

Free trial

You get to make use of WizeFi risk-free for the primary 30 days. Throughout this era, you could have full entry to all options, and you’ll cancel anytime in case you determine it’s not for you.

Month-to-month price

The service is offered for $8.99 per 30 days. This subscription is designed to repay by serving to you probably develop your internet price by tens of hundreds (and even lots of of hundreds of {dollars}) and put you on a quicker observe to monetary independence.

Why isn’t there a free plan?

WizeFi is devoted to offering an entire set of cash instruments and tailor-made recommendation in your monetary development. Not like some free instruments which may limit your potential, your paid subscription makes certain that the providers are high-quality.

Plus, WizeFi stays centered in your monetary well-being, avoiding promotions of exterior merchandise which may battle along with your monetary targets. That is one thing that I actually like about WizeFi – they aren’t attempting to promote you anything – you might be getting a useful cash instrument with none adverts.

WizeFi Safety – Is WizeFi Secure?

When eager about utilizing WizeFi for managing your funds, safety is necessary.

WizeFi makes certain that your data is secure with protecting measures just like these utilized by banks.

In a digital world the place security is necessary, you may calm down realizing that WizeFi doesn’t maintain your account numbers or private particulars inside their app. What you see are the necessary components—your price range and balances. It’s like having a transparent view of your monetary panorama with none doorways open to the non-public account data you don’t wish to share, like account numbers or different private data, making the platform safer for you.

Consider WizeFi as a one-way mirror. You’ve got the total image of your funds at a look, but there’s no path for anybody to succeed in in and transfer issues round.

Continuously Requested Questions

When eager about utilizing a monetary planning instrument like WizeFi, you in all probability have questions on what it affords and whether or not it’s the fitting match for you. Listed below are among the frequent questions answered that will help you determine.

Can I check out WizeFi without spending a dime?

Sure, you can begin with WizeFi without spending a dime. They’ve a 30-day trial interval so that you can discover the total vary of options earlier than you decide to a subscription.

Please click on right here to check out WizeFi without spending a dime for 30 days.

How can WizeFi assist me attain early retirement sooner?

WizeFi is designed to information you in creating a personalised monetary plan. By serving to you customise the fitting price range plan, and observe your spending in opposition to that plan, you’ll simply determine pointless bills you may minimize, which will help you higher handle debt and improve your financial savings charge, which will help you attain your monetary targets quicker.

Is WizeFi price utilizing?

Sure, WizeFi is price it in case you’re critical about taking management of your funds and reaching monetary independence or early retirement.

Does WizeFi have an associates program?

Sure, WizeFi has an associates program the place you may earn 20% of the month-to-month subscription (so 20% of $8.99). Their hope is that individuals will use WizeFi for a month and dial in their very own private funds (craft a brand new plan that makes them really feel empowered to handle their cash for monetary freedom). Then, they’ll share what they’ve discovered with their viewers.

WizeFi Evaluation – Abstract

I hope you loved my WizeFi overview.

In case you are dedicated to bettering your private funds and wish to attain early retirement or monetary independence, I feel that WizeFi is nice to join.

WizeFi stands out from different cash instruments as a result of they deal with growing cash abilities, and never simply supplying you with data, as a result of the WizeFi staff is aware of that cash abilities could make a distinction for a lifetime. Plus, there aren’t any adverts they usually don’t promote your data.

Their aim is to empower an individual to grasp their cash, pace up monetary independence, and dwell their finest, most significant life.

If that’s you, then that is the cash instrument that I like to recommend trying out.

Please click on right here to check out WizeFi without spending a dime for 30 days.

What different questions do you could have about WizeFi?