Picture supply: Getty Photos

I wish to retire comfortably with a second revenue to enhance my pension. With about 30 years left till retirement, I’m making an attempt to determine how I can do this with solely £8,000 in financial savings.

Thankfully, the miracle of compound returns is on my facet!

That, together with a couple of different ideas and methods, might web me a dependable second revenue of £1,000 a month – if I play my playing cards proper.

Cut back my outgoings

Many individuals say one of the best ways to economize is to cut back spending. Effectively, the identical goes for investing – if I scale back my outgoings, I can maximise my returns. On this case, outgoings are tax.

I can minimise my tax by opening a Shares and Shares ISA, which permits tax-free returns on investments of as much as £20,000 a yr. I feel this is a wonderful first step on the journey to reaching my purpose.

Please word that tax remedy relies on the person circumstances of every shopper and could also be topic to alter in future. The content material on this article is supplied for data functions solely. It’s not meant to be, neither does it represent, any type of tax recommendation. Readers are accountable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

Construct a profitable portfolio

There are a number of methods to speculate my financial savings, some simpler than others and a few extra profitable than others. A normal financial savings account is the most secure choice however supplies little or no curiosity. A barely extra unstable authorities liquidity fund often solely returns 4% or 5% a yr.

To purpose for the perfect outcomes, I’m trying to construct a portfolio of 20 or extra diversified shares with long-term progress potential. The UK’s main index, the FTSE 100, has supplied common returns of seven.75% because it started, so I really feel 7% is a conservative common to purpose for.

One instance of a share I plan to purchase is Unilever (LSE:ULVR).

Unilever is among the largest multinational client items corporations, advertising and marketing merchandise to over 190 international locations worldwide. In its newest outcomes launched on 8 February 2024, Unilever reported a 2.6% improve in working revenue since final yr. Its magnificence and wellbeing division carried out greatest, with underlying gross sales progress of 8.3%.

With €75.27bn in belongings and €54.5bn in liabilities, Unilever has €20.76bn in fairness. In contrast with €28.23bn in debt, its debt-to-equity (D/E) ratio of 1.36 is down from 1.73 in early 2022. That’s nonetheless excessive nevertheless it’s enchancment.

Unilever faces the danger of provide chain disruption following the continued battle within the Center East that’s led to assaults on delivery containers. Fluctuating foreign money change charges are one other minor danger, contributing to a slight discount in Unilever’s income this previous yr. Each these dangers threaten the corporate’s general efficiency.

Like many corporations, Unilever’s share worth has been subdued not too long ago because of lingering impacts of the pandemic. Nonetheless, taking a look at a 30-year timeframe, I can see how Unilever recovered effectively following each the 2000 and 2008 market crashes.

Maintain constructing my funding

I do know that my preliminary financial savings alone are usually not sufficient to succeed in my purpose of £1,000 a month in returns. I might want to make some extra month-to-month contributions for the following 30 years if I hope to do this.

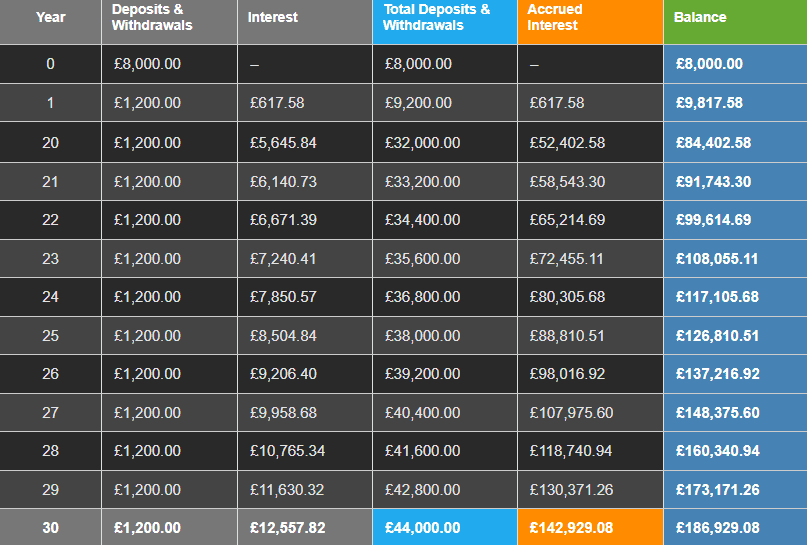

If I can preserve a median annual return of seven% and make investments an additional £100 a month, then my funding might develop to £186,929 in 30 years. That might web me returns of £12,557 a yr – simply over £1,000 a month.