Picture supply: Getty Pictures

There are many ways in which traders can goal a second revenue in retirement.

Some strategies could also be extra profitable than others. There’s additionally no blueprint for traders to observe, because the methods somebody adopts will rely on their particular person circumstances, monetary objectives and danger tolerance.

That mentioned, sure ‘golden guidelines’ exist relating to saving or investing. No matter private state of affairs, they are often highly effective weapons in creating long-term wealth.

1. Bypass the taxman

The very first thing to contemplate is utilizing a Self-Invested Private Pension (SIPP) or Particular person Financial savings Account (ISA) to speculate. Throughout the ISA class, a Shares and Shares ISA and/or Lifetime ISA can be utilized to purchase shares, trusts and funds listed within the UK and abroad.

With each an ISA and a SIPP, an investor doesn’t pay a single penny in tax on any capital positive factors and dividends. And given the massive annual allowances on these merchandise — £20k on a Shares and Shares ISA, and a sum equal to 1’s yearly earnings (as much as £60k) — the financial savings will be appreciable.

As dividends and share costs (hopefully) develop, the quantity saved on taxes might develop significantly too. Over two-to-three a long time we might be speaking many tens — and even a whole bunch — of 1000’s of kilos.

Please notice that tax therapy is determined by the person circumstances of every shopper and could also be topic to vary in future. The content material on this article is offered for info functions solely. It’s not supposed to be, neither does it represent, any type of tax recommendation. Readers are accountable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

2. Diversify

With an ISA and/or SIPP arrange, the following factor to contemplate is making a diversified portfolio of shares and different property. This reduces danger, supplies publicity to totally different investing alternatives, and usually delivers a smoother return over the financial cycle.

A belief just like the The Metropolis of London Funding Belief (LSE:CTY) might be an efficient inventory to contemplate concentrating on this. Relationship again to 1932, this is without doubt one of the oldest London-listed trusts, and has round £2.4bn value of property.

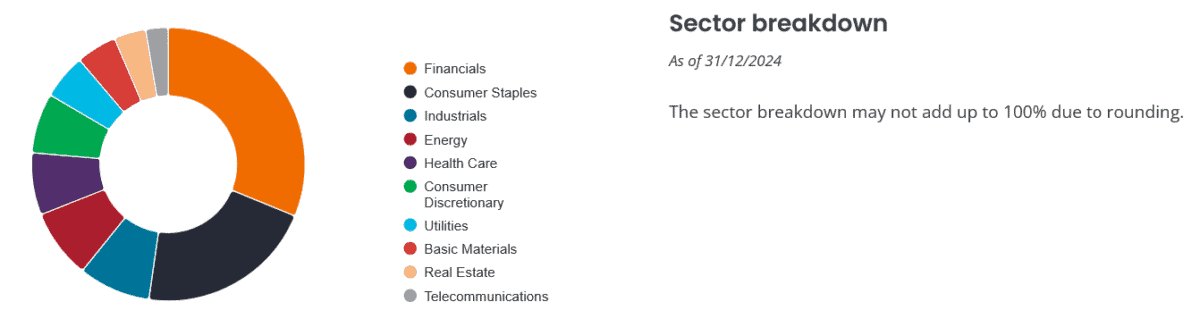

It’s centered on delivering a mix of progress and passive revenue by publicity to 10 totally different sectors. A few of its largest holdings embody HSBC, Shell, RELX, Unilever and British American Tobacco.

Nearly 90% of the fund is tied up in UK equities, which might depart it weak if market urge for food for British property tendencies decrease. However I’m assured it might proceed to be an efficient diversification instrument over the long run.

Since 2005, the belief has delivered a median annual return of 6.4%. If this continues, a £500 month-to-month funding over 30 years creates a retirement fund of £553,089.

3. Purchase dividend shares

As soon as they hit retirement, an investor has a variety of choices open to them so as to add a second revenue to their State Pension.

They will purchase an annuity, or draw down a proportion from their portfolio. Alternatively, they could make investments their cash elsewhere (like in buy-to-let property for an everyday rental revenue).

An alternative choice is to focus on a passive revenue from high-yield dividend shares. This could ship a gentle stream of money by common dividend funds in addition to present scope for capital appreciation.

Moreover, this technique affords the opportunity of dividend progress over time, which may also help mitigate the eroding influence of inflation on a person’s passive revenue.