Picture supply: Getty Photographs

Incomes an ample second revenue for little (or no) effort in retirement is the dream of all buyers. It’s my plan to attain this by constructing a diversified portfolio of FTSE 100 and FTSE 250 dividend shares.

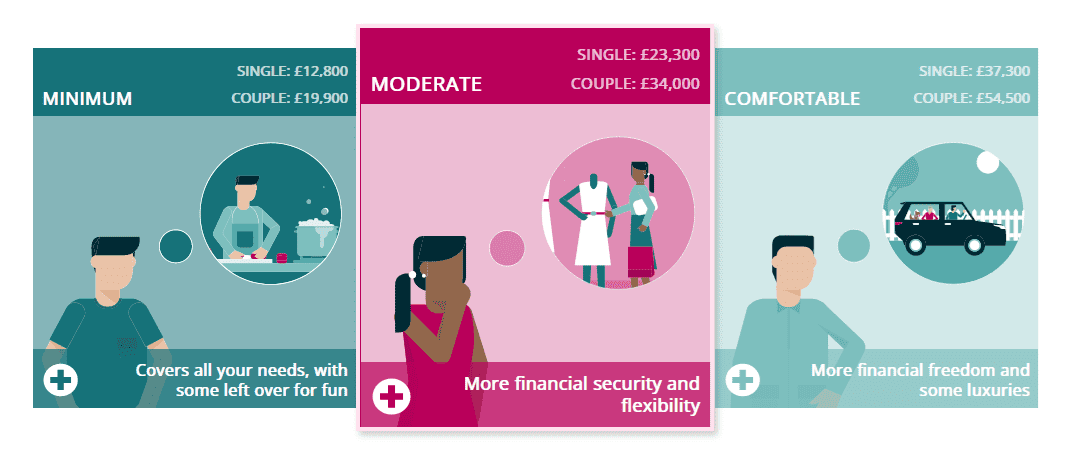

How a lot one will probably be have to have accrued by retirement age differs from individual to individual. However an excellent technique might be to observe what the Pensions and Lifetime Financial savings Affiliation thinks the typical Brit will want as soon as they hit retirement age.

They imagine retirees will want an annual revenue of £23,300 to get pleasure from a ‘reasonable’ lifestyle. A much-higher determine of £37,300 is required for people to reside comfortably.

Right here’s my plan

This leaves a giant downside for people who find themselves counting on the State Pension to fund their retirement. As of April, the pension is scheduled to come back in at simply £11,502 a 12 months.

This leaves a shortfall of round £25,800 for many who need to get pleasure from a ‘comfy’ lifestyle. And I imagine this disparity will develop even bigger by the point I personally grasp up my work apron for good as the price of residing and social care soars.

However I’m not panicking. Whereas future income are usually not assured, the gorgeous returns UK share buyers have made in current a long time counsel I might reside comfortably no matter what the long run holds for the State Pension.

Compound beneficial properties

My optimism is predicated on the distinctive returns that FTSE 100 and FTSE 250 shares have delivered over the long run.

Footsie buyers who reinvested all of their dividends between 2010 and 2019 loved a median annual return of 8.3% between. In the meantime, those that purchased FTSE 250 shares loved a good higher yearly return of 13%.*

Reinvesting dividends is the important thing to supercharging one’s long-term wealth. Doing this with dividends permits me to build up extra shares, resulting in elevated dividend payouts and thus the possibility to purchase extra shares.

Over time, this mathematical miracle (generally known as compounding) may help me make market-beating returns.

* Figures courtesy of IG Group.

A £3,337 second revenue

Now I’ll present you ways compounding may help me make a passive revenue in retirement. Let’s say that I’ve a lump sum of £20,000 to construct a balanced portfolio of UK blue-chip shares.

Over the area of 30 years, and with an additional £200 invested every month, I’d have constructed a formidable nest egg of £1,001,225 to retire on. That’s primarily based on the typical 10.65% return for FTSE 100 and FTSE 250 shares in the course of the 2010s.

If I then drew down 4% of this quantity a 12 months, I’d have a superb month-to-month revenue of £3,337. On an annual foundation this works at £40,049.

That may be sufficient to offer me that comfy retirement that the PLSA describes. And that’s not even bearing in mind the additional enhance that the State Pension will present to my funds.

There might be bumps alongside the way in which. However I’m assured that, with the fitting funding technique (and assist from specialists like The Motley Idiot) I might make a big passive revenue for my later years.