Picture supply: Getty Photos

With a lump sum funding, buyers may begin a journey with a Shares and Shares ISA which may ultimately see them turn into completely financially unbiased.

Personally talking, I don’t need to take an opportunity with my retirement by counting on the State Pension. The scale of the profit I obtain, together with the age at which I can draw upon it, is more and more unsure because the UK struggles to fund its fast-growing aged inhabitants.

So I’ve a plan to construct long-term wealth. It’s a method that, for buyers with a £20,000 lump sum at this time, may probably present a month-to-month passive revenue above £3,000.

Ta-ta, taxman

Step one I’ve taken is to spend money on a tax-efficient product like a Shares and Shares ISA. This fashion, I’ve managed to maintain any capital positive aspects and dividend curiosity I obtain out of the arms of the taxman.

Over many years of investing, this could add as much as tens of hundreds of kilos, maybe extra.

Asset supervisor Netwealth not too long ago informed the Monetary Instances that an extra fee taxpayer investing £100,000 in a Shares and Shares ISA would, based mostly on a median annual return of 5.9% over 10 years, save a whopping £44,000 in taxes.

Please notice that tax therapy depends upon the person circumstances of every shopper and could also be topic to vary in future. The content material on this article is offered for data functions solely. It isn’t meant to be, neither does it represent, any type of tax recommendation. Readers are answerable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding selections.

A giant passive revenue

The following factor I’ve achieved is construct a diversified portfolio of shares, funds and trusts with my ISA. I personal round 10-15 corporations that span a mess of sectors and areas. I’ve additionally sought out a mixture of worth, dividend, and progress shares.

By spreading my funding like this, I’m boosting my probabilities of attaining regular, long-term portfolio progress whereas balancing potential dangers.

With this technique, I consider a median annual return of 8.5% is a practical and achievable aim. This determine sits on the midpoint between the FTSE 100‘s historic long-term common return of round 7%, and the S&P 500‘s larger common return of roughly 10%.

Previous efficiency is not any assure of future earnings. However buyers who can obtain that 8.5% return would — with a £20k funding, and an extra £300 top-up every month — have a Shares and Shares ISA price £749,061 after 30 years.

They might then get pleasure from a wholesome month-to-month revenue of £3,121 a month by switching this into 5%-yielding dividend shares. That is the following stage of my very own investing plan.

A prime belief

A easy and cost-effective option to hit this aim may very well be by contemplating an funding in a belief. Alliance Witan (LSE:ALW) — which is about to be promoted to the FTSE 100 from the FTSE 250 — is one such pooled funding I’m fascinated about at this time.

This is among the UK’s largest funding trusts following the latest merger of Alliance Belief and Witan Funding Belief. It has whole property of round £5.5bn, and holds shares in additional than 230 corporations.

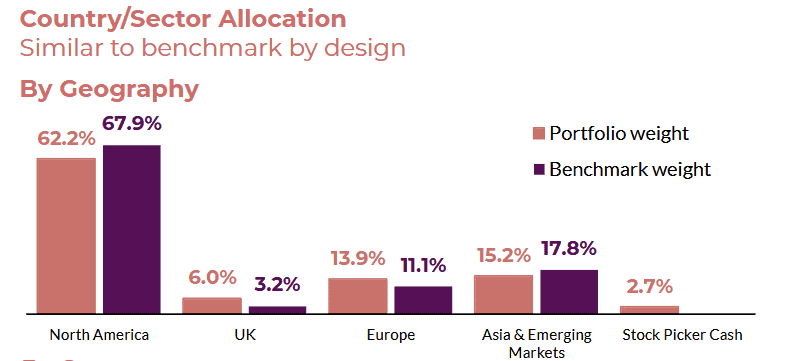

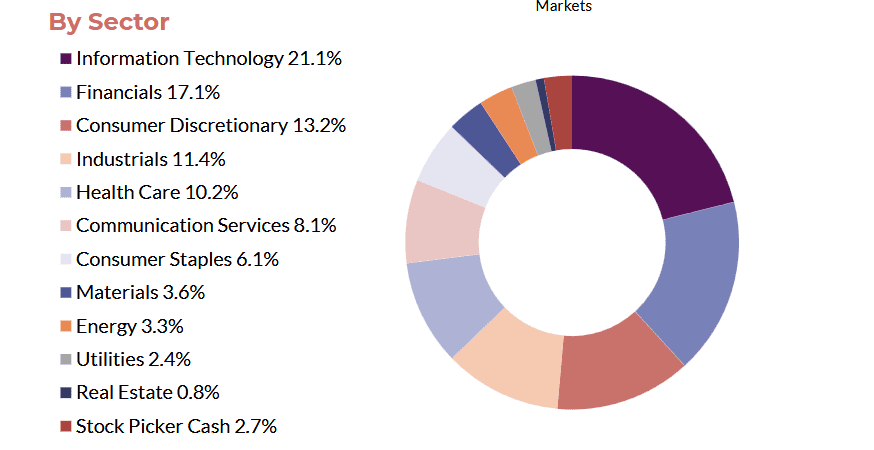

These shares are unfold far and huge, by business in addition to area, as proven under. This helps buyers to handle threat, in addition to acquire publicity to all kinds of funding alternatives.

On the draw back, the belief has vital publicity to cyclical sectors like expertise, industrials and financials. This can lead to disappointing efficiency throughout financial downturns.

However over the long run, I’m optimistic it may possibly proceed delivering a wholesome return. It’s why it’s close to the highest of my ISA buying listing at this time.