Picture supply: Getty Photos

A Shares and Shares ISA may be an distinctive option to generate passive earnings. With tax advantages boosting capital features and dividend earnings, a lump sum or an everyday funding can ship a life-changing second earnings in retirement.

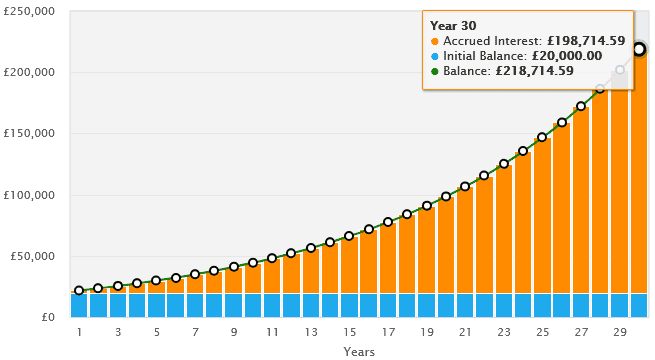

If an investor parked £20,000 in considered one of these ISAs in the present day, right here’s how they might finally get pleasure from a roughly £1,000 tax-free money fee each month.

Please observe that tax therapy is determined by the person circumstances of every consumer and could also be topic to vary in future. The content material on this article is supplied for data functions solely. It’s not supposed to be, neither does it represent, any type of tax recommendation. Readers are liable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding choices.

Concentrating on £1k

There are a number of ways in which people can goal passive earnings in retirement.

They’ll draw down a set share from their portfolio, or swap into dividend shares that pay an everyday earnings. They’ll additionally purchase an annuity that gives a assured sum for all times. Or they’ll choose a mixture of some or all the above.

I like the concept of shopping for dividend shares, as — over time — it will probably ship a second earnings whereas nonetheless permitting scope for portfolio progress. It’s the trail I plan to go down. So how giant would my ISA must be for an approximate £1,000 month-to-month earnings?

If I focused dividend shares with 6% yields, I’d have to have £218,715 sitting in my portfolio once I retire. That would supply me with £1,094 every month.

To attain this with £20,000 in my ISA, I’d have to focus on a mean annual return of 8% over 30 years.

However how reasonable is that this type of return? ‘Very’ is the reply, if the long-term efficiency of the inventory market’s something to go by.

Strong returns

| Inventory Market Index | 10-Yr Common Annual Return |

|---|---|

| FTSE 100 | 6% |

| S&P 500 | 11.7% |

| AVERAGE | 8.9% |

As you’ll be able to see, somebody who invested in UK and US blue-chip shares would have loved a near-9% annual common return during the last decade.

Historical past isn’t at all times a dependable information to future funding features. However the broader inventory market has, again and again, proved its potential to rebound from crises and ship highly effective returns over time.

An investor in the present day might goal a big earnings by investing in particular person shares and shopping for an exchange-traded fund (ETF). The iShares S&P 500 ETF (LSE:CSPX), as an illustration, is value contemplating as a direct option to harness the S&P 500’s good long-term returns.

It is a fund I maintain in my very own portfolio. By spreading my money throughout a whole lot of US shares, I can seize the large progress potential of tech shares (like Nvidia and Apple) whereas additionally diversifying to mitigate threat.

Just below a 3rd (31.6%) of the fund is devoted to data expertise firms. The rest is unfold throughout a number of sectors together with monetary companies, client items, communications and healthcare.

By reinvesting dividends, this fund makes use of the facility of compounding — incomes a return on all my previous returns — to supercharge long-term progress as nicely.

Funds like this will ship poor returns throughout financial downturns. However over time, they’ve been nice methods to unlock a wholesome earnings for retirement.