Picture supply: Getty Photos

Previous efficiency shouldn’t be a dependable information to the longer term. However historical past reveals {that a} balanced portfolio of FTSE 100 shares may help Shares & Shares ISA holders like me construct a giant nest egg for retirement.

Britain’s main UK share index delivered a mean annual return of seven.48% between 1984 and 2022. Had I invested £25,000 in the beginning of that interval and sat again, I’d have a really respectable £234,138.06 sitting in my checking account.

That’s not unhealthy. However I feel I can do higher.

Reasonably than investing in one thing like a FTSE 100 tracker fund, I choose to seek for particular person shares to purchase. The 2 I’m at present contemplating shopping for are Ashtead Group (LSE:AHT) and JD Sports activities Style (LSE:JD.).

Millionaire maker

Why these specific shares, you ask? Properly, through the 2010s they have been among the many Footsie’s best-performing shares.

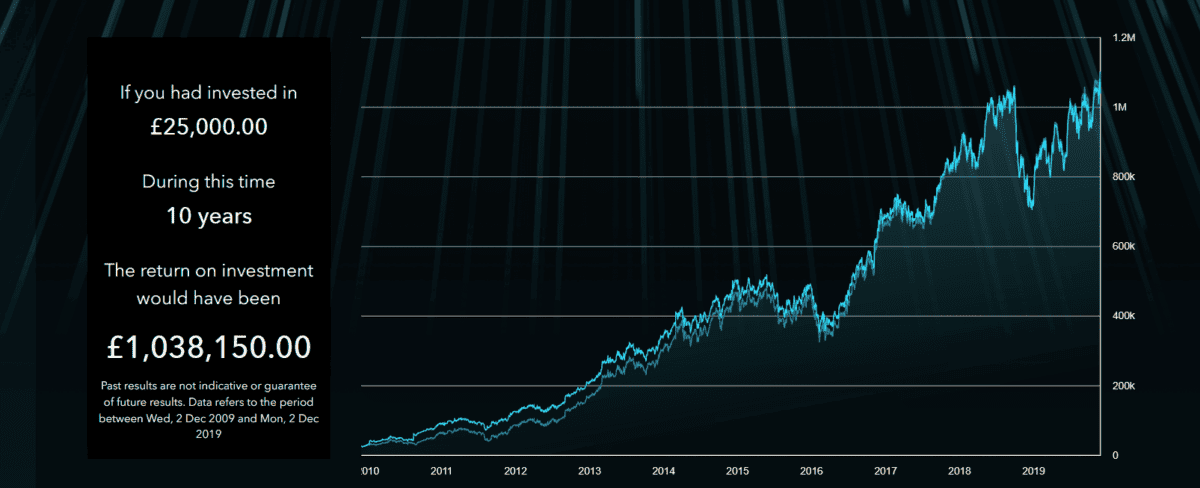

Take Ashtead, for instance. An funding of £30,000 within the rental tools supplier on 2 December 2009, would have turned me into an ISA millionaire, because the chart under reveals.

I’m assured that it may proceed delivering smashing returns through the 2020s and past, too.

To reiterate my earlier level, there’s no assure that previous returns could be replicated. However right here is why I consider these FTSE 100 shares may assist me in my quest to change into a inventory market millionaire.

Rental big

I already personal Ashtead shares in my Shares & Shares ISA. Its profitable acquisition-based development technique has fashioned the bedrock for electrifying earnings (and thus share worth good points) over the previous decade.

And I’m hopeful this pattern will proceed: sturdy money technology actually provides it the means to proceed rising its market share by extra bolt-on buys.

I’m additionally anticipating market circumstances to steadily enhance over time, giving its revenues a giant kick.

There may be some uncertainty within the close to time period as excessive rates of interest curb development exercise. However predictions of stable financial development within the US — allied with elevated infrastructure spending throughout its North American and UK markets — bode properly for Ashtead over the long run.

Sports activities star

An funding of £30,000 in JD Sports activities on 2 December 2009 would have became £736,320 a decade later. Whereas it may ship disappointing returns within the close to time period, I nonetheless count on its shares to provide tasty returns for the 2020s as a complete.

Athleisure demand is beneath strain in the intervening time amid weak shopper spending ranges. That is particularly the case within the FTSE 100 firm’s US territory. Nonetheless, the long-term outlook for this style section stays extremely promising, and particularly on the premium finish of the market the place JD specialises.

Analysts at 360iResearch suppose the worldwide athleisure market will develop at an annualised fee of 18.8% between 2023 and 2030. And JD, by its worldwide growth drive, may very well be in an awesome place to capitalise on this.

I’m assured each these FTSE 100 shares will stay star performers. And I plan to seek for extra profitable shares to assist me in my quest to change into a inventory market millionaire.