Picture supply: Getty Photos

For many years, funding methods targeted on FTSE 100 shares have confirmed to be an effective way to generate long-term wealth. My very own stock-buying philosophy is geared closely in the direction of Footsie shares, complemented with a peppering of FTSE 250 shares.

Who can blame me? The UK’s main share index has delivered an excellent 7.5% common annual return since 1984. That’s significantly better than the return traders might have made with low-yielding financial savings accounts over that interval.

Previous efficiency is not any assure of future positive factors. However let me present you ways I might make a wholesome passive revenue for retirement with FTSE 100 shares.

A £25k+ passive revenue

On my journey to create long-term wealth I’ve laid down the next standards:

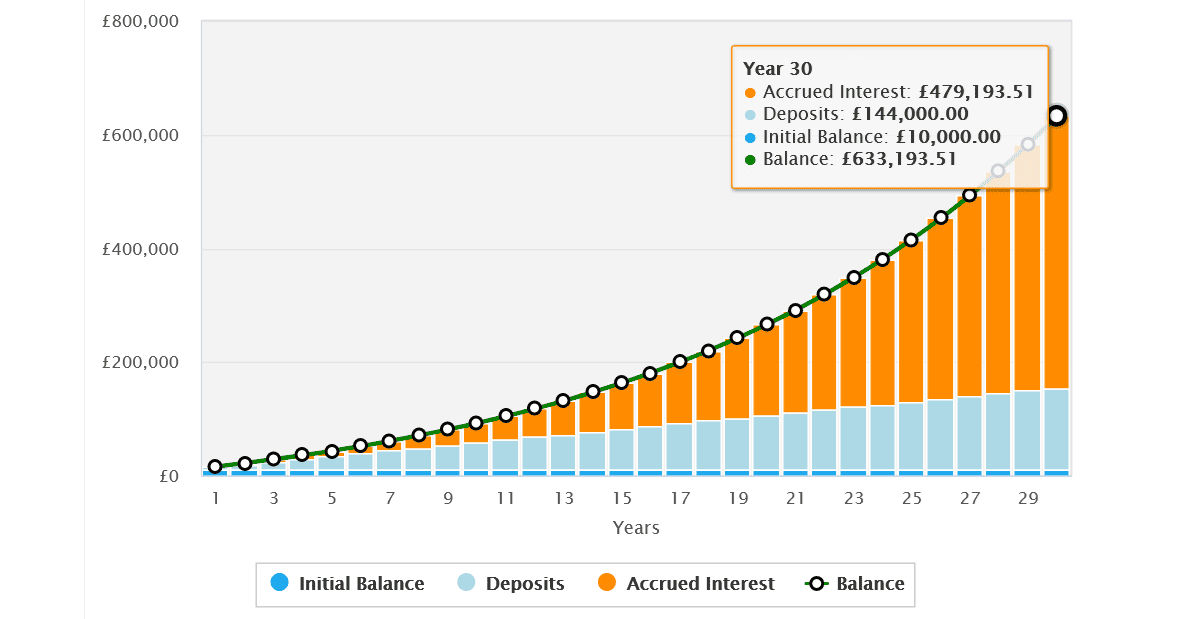

- To place £10,000 in a tax-efficient Shares and Shares ISA at first

- To speculate this sum — together with an additional £200 every month — in FTSE 100 shares

- To reinvest any dividends I obtain in additional Footsie shares

- To retire in 30 years, giving my retirement fund loads of time to develop

If I handle to fulfill all of those standards — and assuming that the Footsie’s 7.5% common yearly return stays in tact — I’d have made a formidable £633,194 by the top o it.

If I then selected to withdraw 4% of this sum down every year I’d take pleasure in a good revenue of £25,327. Why 4%, you ask? At this stage, I might draw a passive revenue for 3 a long time earlier than my retirement pot ran dry.

A FTSE 100 share I’d purchase

I’d additionally have to unfold my internet extensive and never simply put money into a small pool of comparable Footsie shares. This slender focus might see me miss out on development alternatives elsewhere, and depart me uncovered to better danger from industry- and economic-related elements.

As an alternative, I’d look to construct a broad portfolio of at the least 15 shares that span completely different sectors, geographies, and which carry out in another way at every stage of the financial cycle. This manner I can proceed rising my portfolio when occasions are good in addition to when issues get powerful.

I’d additionally search corporations that boast sturdy financial moats, as investing knowledgeable Warren Buffett would describe. These are aggressive benefits that safeguard long-term earnings and defend market share from rival companies. GSK (LSE:GSK) is an ideal instance of 1 such inventory, I really feel.

Buffett as soon as held the corporate’s shares by his Berkshire Hathaway agency, and it’s straightforward to see why. A lot of its medicine (like its Shingrix shingles therapy) are leaders of their fields. The agency can also be a number one power within the fast-growing vaccines market because of heavy funding lately.

It’s additionally not straightforward and low-cost to develop prescription drugs merchandise, which protects the agency from the specter of new market entrants. GSK spent a whopping £5.5bn on analysis and growth in 2022. That’s greater than the market-cap of many FTSE 100 corporations.

Growing medicine is an costly and complex enterprise. And troubles on the lab bench can have a major affect on earnings. However GSK has a superb observe file on this entrance, which is why I’m wanting so as to add it to my portfolio after I subsequent have money to speculate.